Have the ability to render evidence of lack of has the benefit of out-of financing from a couple loan providers (Lender otherwise Strengthening Neighborhood loan providers only)

Rebuilding Ireland Mortgage is actually a national supported mortgage to possess first day customers. Its offered nationwide out of all the regional authorities off initially .

While the an initial time important source customer you could sign up for a Rebuilding Ireland Mortgage buying a separate otherwise second-give possessions, or even to create your own home.The mortgage try a frequent Investment and Focus-bearing home loan that is paid down of the direct debit for the a monthly basis.You can acquire to 90% of your market value of the property.

- 320,000 regarding the areas out-of Cork, Dublin, Galway, Kildare, Louth, Meath and you will Wicklow, and you will

- 250,000 regarding rest of the country.

Warning: Unless you keep pace your instalments you may want to cure your house. The expense of the monthly costs could possibly get improve. You may have to spend costs for those who repay a fixed-rate loan early.If you don’t meet up with the money on the loan, your account is certainly going into the arrears.

This could apply to your credit score, that could limit your capability to access credit subsequently

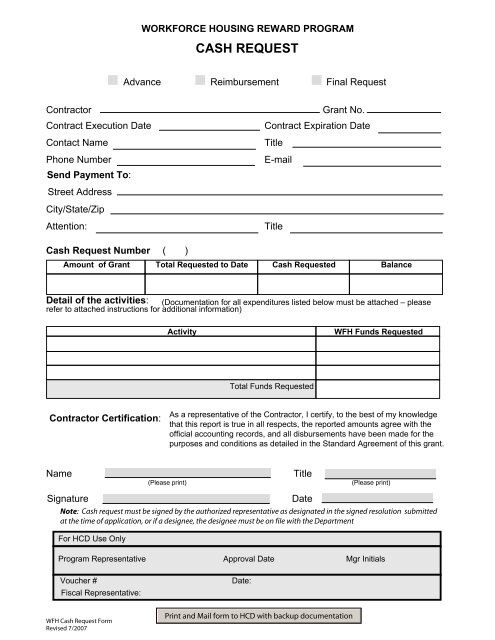

If you were to think youre eligible and will pay the repayments into matter you ought to obtain, you could potentially over good Reconstructing Ireland Home loan application.You ought to complete most of the areas of the program and provide the fresh new support files demonstrated on applicant list.

step 3. End up being earning not as much as fifty,000 (gross) in the earlier tax season because the just one applicant or even in the fact away from a joint app one another revenue shouldn’t be higher than 75,000 (gross) in the earlier income tax season.

4. Get into carried on work (this is exactly self employed) for around a couple of years in the example of the primary earner plus persisted a career for starters year in the case from an extra applicant (in the event that next applicant is used).

5. Become of great position having a suitable credit record (a credit assessment is finished with the new Irish Credit Agency together with courts before loan approval is actually provided).

10. While you are leasing, you truly need to have a definite book be the cause of half a year earlier to help you applying for the mortgage and your rent assessment should be high tech. For individuals who satisfy the over requirements you may be permitted sign up

Your application means need to be signed by the all the individuals and submitted into local expert. Applicants was highly told add its apps privately, because the released applications are often not finished truthfully and just have so you’re able to be returned.

The application will be examined and you will be advised from the decision in writing. Lending requirements, fine print implement. Safeguards and Insurance coverage needed. More information on exactly how to use is obtainable from our let desk from the 051 349720 (8am in order to 5pm Tuesday in order to Monday) or from your local power. After registered, all the queries when considering the application together with choice is to be directed on the local power.

- 2.745% fixed for twenty five years (Annual percentage rate dos.78%)*

- dos.995% repaired for as much as 3 decades (Apr 3.04%)*

All costs try personal out-of Mortgage Shelter Insurance (MPI) that is a requirement off borrowing. Eligible individuals have to partake in nearby authority collective MPI strategy. MPI try payable month-to-month, as well as loan payments.

- The month-to-month repayments are nevertheless a comparable into full fixed speed loan several months, and then make budgeting simpler but when you look at the fixed rate several months, you may be accountable for a great breakage payment for those who shell out regarding all the or element of the home loan.