Of a lot People in the us don’t understand he or she is subjects away from a loan amendment scam up until its too late. With increased monetary filter systems throughout the pandemic and an upcoming credit crunch, aware home owners can safeguard by themselves from shedding victim to help you mortgage loan modification scams of the focusing on how to determine the newest warning flag.

Is a snippet from just what experience you are going to entail. Your, and additionally 164,580 other American homeowners, decrease about on the mortgage payments in the first 50 % of 2022. You know you’ll in the near future have the dreaded page that home loan servicer keeps id so it worry, you receive a call away from a phone number. The individual on the other line phone calls themselves a good loan mod representative, as well as somehow know about your own financial situation. They show not to worry and that they might help. People say they can produce a loan amendment. In reality, they are guaranteeing that they could allow you to get a simple you to. You aren’t also yes just what financing modification is actually. You will do a bit of research and discover that a mortgage loan amendment try a contract to change the brand new regards to their funds, commonly employed by residents experience foreclosure.

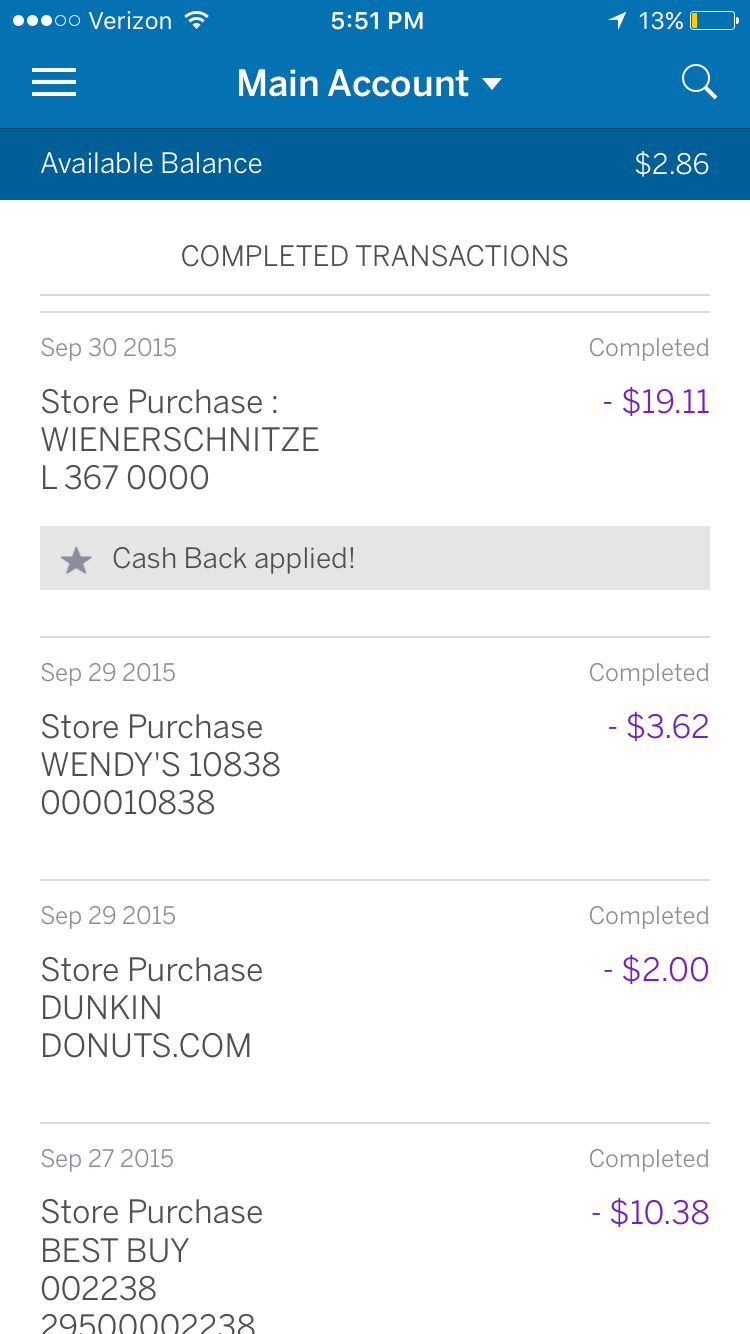

The call feels like an excellent beacon out of promise. You have been getting frightening emails throughout the send, all of the out-of some other offer that also for some reason find out about your property foreclosure. Particular state he is permitted costs. Someone else tell avoid and also make loan costs altogether. Particular also tell you firmly to file for bankruptcy. This might be all daunting, and thus employing who you spoke in order to yesterday seems like the best option. Its agency’s web site seems legitimate (it even possess testimonies!), until such time you are located in its well-decorated office space to own an appointment. Afterwards one to month, they provide a few documentation to fill out with your personal information and sign. It charges upfront costs. What they are requesting isnt inexpensive, however you are https://www.availableloan.net/payday-loans-ny/ willing to pay anything you are able to afford in the event the this means keepin constantly your household. At the least he’s letting you spend from inside the monthly premiums. An integral part of your warrants the cost, believing that things lower to have instance an elaborate processes would definitely become a fraud. Definitely, this new scam has already happened. Did you catch one warning flags?

Really informing is that its unlawful getting loan mod organizations for one payment upfront. Costs getting helping which have financing modification may only become obtained pursuing the attributes was indeed rendered. Actually, the latest York Attorney General’s Workplace prompts residents so you can declaration these abuses. Next, banks aren’t necessary to grant some body that loan amendment. A lender could possibly get refuse to give a modification for different explanations, dependent on someone’s financial obligation-to-money ratio and/or sufficiency of the proof difficulty. For this reason, the fresh new guarantee one to financing amendment company renders is nothing over an blank promise.

Thus, what direction to go? Basic, declaration new scam artist to the Attorney General’s office and block its number. Next, property owners will be get in touch with a great U.S. Company away from Casing and Metropolitan Invention (HUD) recognized housing counseling agencies. There are lots of non-cash groups that provides loan mod advice including give suggestions to attorneys. The fresh new HUD website lists these types of organizations by the condition.

The fresh new Lawyers’ Committee’s Federal Mortgage loan modification Scam Database amassed studies out of and you may showed that there have been more than 42,000 foreclosures cut ripoff issues and you may an impressive $98 mil of losses to residents

Be aware that 100 % free help is offered. Brand new stakes out of in the process of property foreclosure legal proceeding try highest, and is also regular to feel concern about position the future of your property in the possession of off a no cost otherwise affordable solution. But not, that it stress is exactly exactly what mortgage loan modification scammers is focusing on. HUD-accepted businesses also provide their sense and possibilities to greatly help pick tailored selection getting people. That have assistance from a professional institution or lawyer, people will not only avoid loan mod frauds, but could and additionally renegotiate its mortgages and more readily browse the brand new government House Reasonable Modification Program (HAMP). In reality, NeighborWorks The usa, a low-cash team chartered because of the Congress, recorded a beneficial Congressional Posting of its mortgage-counseling program, appearing you to property owners having counseling are nearly 3 x more likely for that loan modification as compared to home owners instead guidance. In the process of property foreclosure are a remarkably stressful sense, so if anything appears too good to be true, they probably try.

Caroline Nagy & Michael Tanglis, Who’ll Your Believe? The latest Foreclosures Help save Scam Crisis into the Nyc, sixteen (Matthew Hassett & Christie Peale eds., 2014).

:text=Scam%20artists%20offer%20to%20act,forward%20payments%20to%20your%20lender. Loan modification scammers often use public listings or information purchased from private companies to seek out their targets. Come across id.

Third, there isn’t any factor in financing modification agency to inquire about for your individual economic suggestions-the financial already has actually everything it takes

See Erica Braudy, Taxation a bank, Help save a home: Judicial, Legislative, or any other Innovative Services to avoid Property foreclosure when you look at the Ny, 17 CUNY L. Rev. 309, 317 (2014).