- Do i need to pay my Fifth Third Bank doctor financing early instead a penalty?

Yes, 5th Third Financial will not fees a good prepayment punishment, providing you the flexibility to pay off your loan very early without a lot more costs.

- Which are the specific credit rating conditions?

- Generally speaking, a credit history with a minimum of 720 will become necessary to own an excellent 5th Third Financial physician financial to make certain eligibility to find the best cost and you will conditions.

Once you have safeguarded the doctor loan off 5th Third Lender, controlling it effortlessly is essential for very long-label monetary fitness. Listed below are some solutions to make it easier to control your financial responsibly:

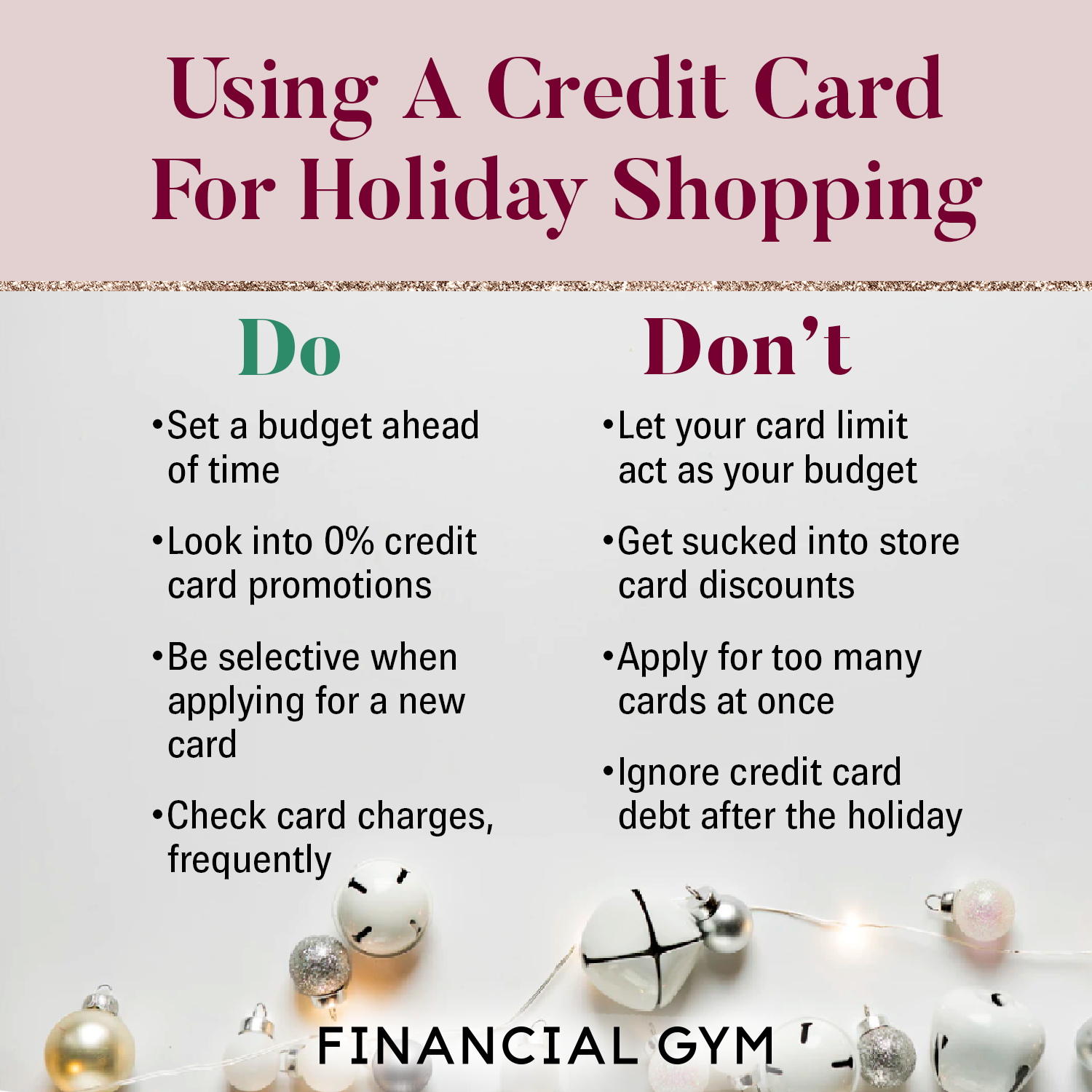

step 1. Budget Intelligently

.png)

Maintaining a solid funds is essential. Become their mortgage payments and one associated expenses, such as for instance property taxes and home insurance, in your monthly finances. Ensure that you take into account the potential of ascending interest rates in the event that you’ve selected a varying-speed mortgage (ARM).

2. Build an emergency Loans

Unanticipated events make a difference your ability and also make fast mortgage repayments. An urgent situation financing coating about 3 to 6 weeks from living expenses, together with your financial, also have a back-up during the financial concerns.

3. Believe A lot more Repayments

In case your financial situation lets, while making a lot more repayments to your their home loan dominating can reduce the overall focus you only pay over the longevity of the mortgage and you may potentially reduce the mortgage term.

cuatro. Stand Informed Regarding the Refinancing Selection

Be mindful of interest rate fashion. If the cost get rid of rather, refinancing your physician loan you’ll reduce your monthly payments or create you https://paydayloancolorado.net/evans/ to definitely option out of a varying in order to a fixed-rate home loan, getting much more predictable financial planning.

5. Speak with Monetary Advisors

On a regular basis consulting with a monetary advisor helps you create informed decisions regarding your mortgage inside the framework with your bigger monetary wants, such as for example old-age believed and you may financing strategies. If you find yourself only starting and do not features a beneficial financial mentor we recommend sitting down and you will considered aside exactly what your second step three-5-7 years seem like whilst in home.

Long-Label Considered Together with your Doctor Mortgage

Committing to real estate due to a health care provider financing is not just on interested in a spot to live; additionally, it is a proper monetary disperse. Since your occupation progresses and your income expands, you have got additional opportunities to influence your own property’s collateral to own subsequent monetary benefits, including committing to a lot more possessions otherwise to make high renovations.

Getting Proactive with Mortgage Management

Active handling of a family doctor loan is vital. Continuously opinion the loan statements, stay on better of every alterations in terms and conditions, and constantly be hands-on regarding contacting their bank for people who anticipate one issues in making costs. Active communication together with your bank can often offer choices to mitigate possible factors.

Leverage Your residence to own Upcoming Monetary Balance

You reside not only an actual physical asset; it’s a significant part of your own monetary profile. As you generate collateral, you’ve got opportunities to put it to use to bolster debt coming, whether as a consequence of refinancing to raised words otherwise having fun with household guarantee outlines regarding borrowing from the bank to many other tall costs otherwise expenditures.

Secure Your next Now

Carry on your happen to be homeownership with full confidence. We away from specialist lenders focuses primarily on medical practitioner mortgages and that’s right here to guide you through each step, ensuring you have made the very best words to match your unique requires. Reach out today to explore how a fifth Third Lender physician mortgage can be section of your financial means, working out for you safer not only property, also a reliable and you will successful coming.

- 5th Third Bank’s physician financing rates are very competitive, bear in mind regardless of if, this is exactly a profile device. Loan providers may come inside and out of one’s business on the year.