Very mortgage individuals deal with new dilemma of whether or not to play with the month-to-month offers so you’re able to prepay its mortgage or set it out for problems. More often than not, the additional money just lies within discounts profile generating below par (and taxable) desire. A home saver loan allows you to feel the pie and you will eat they also. It’s possible so you can park which amount yourself financing account fully for a variety of weeks and you can eliminate it when to suit your immediate need otherwise normal expenditures once they end up being due (elizabeth.grams., purchasing students college or university costs every quarter). The bucks hence kept in our home loan account decreases the total desire outgo on your own home loan and assists your personal your loan less.

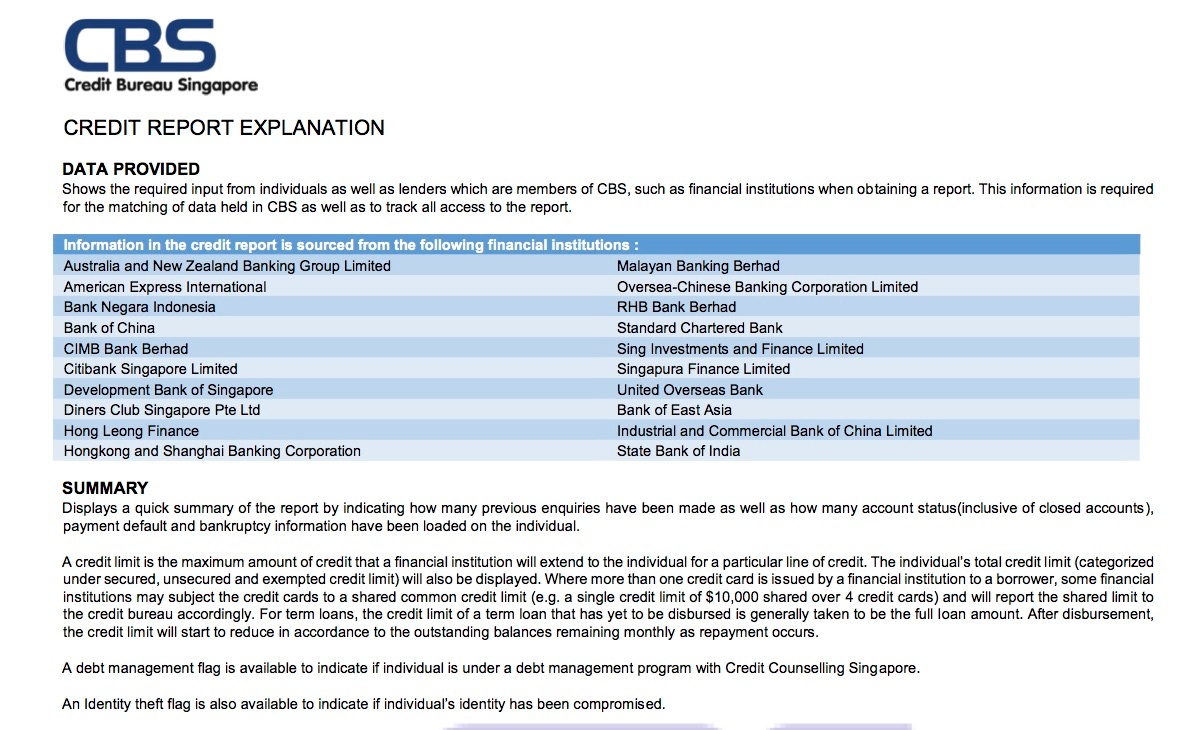

MaxGain try a popular household saver loan device regarding SBI. Comparable home saver finance, albeit with assorted interest rates, can also be found from other banks in addition to Citibank (House Credit), Simple Chartered Bank (HomeSaver), HSBC (Wise Domestic) and IDBI Bank (Financial Notice Saver).

We’re going to attention only toward SBI MaxGain on this page. Other family saver financing in the list above are very equivalent and may also disagree in the minor info. Prior to we dig better on the SBI MaxGain, why don’t we know what is actually an overdraft (OD) membership.

What is overdraft (OD)?

An enthusiastic overdraft studio was a personal line of credit agreed to somebody facing their property. You could potentially consider it nearly the same as a credit card which have a limit but without the focus-totally free (grace) months. i.e., the interest clock initiate ticking once the matter was taken rather than prepared until the payment deadline. The speed toward overdraft account is normally lower than borrowing from the bank credit. You could potentially withdraw currency upto the newest sanctioned restriction and certainly will keeps to repay new the harmony and additionally attention just for brand new period which you make use of the funds from new account.

Exactly how try SBI MaxGain unlike regular mortgage brokers?

SBI MaxGain is actually a mortgage which is approved because the an enthusiastic OD having a limit that is comparable to this new acknowledged loan number. Your residence acts as the underlying defense into OD membership. This product gets the same interest as the almost every other household loans out of SBI upto Rs. 1 crore (during this composing). A made off 0.25% try applied for lenders significantly more than Rs. step one crore. There is absolutely no more charges for usage from OD business. The current account (OD) has cheque guide and you can online banking studio.

- whose income commonly constant self-working otherwise businessmen. From the a recently available a house exhibition, SBI told me you to MaxGain actually readily available for brand new notice-functioning and you can entrepreneurs.

- who possess an occasional (every quarter, semi-yearly or annual) bonus or varying pay factor that will be left from the OD account.

- who’ve savings right after paying EMI or any other monthly expenses.

- NRIs and you will professionals that have highest income.

- Abreast of finally disbursal, your Restrict and you may Drawing Electricity often equal the new approved loan amount. These types of amounts will certainly reduce with each EMI payment.

- Attracting Electricity = The dominating amount borrowed.

- Available Balance = One excess number parked within account + accumulated attention savings. More on that it lower than (Section 5 via 8).

- Publication Balance = Attracting Power Available Equilibrium. It is found because an awful (minus) number.

- Your own month-to-month EMI will not vary even after surplus number on OD membership.

- Dominant portion of the EMI was put on brand new time out of EMI payment and you will would go to reduce the Attracting Energy additionally the Limit. The main portion of the EMI is computed according to the fresh amortization schedule. Excessive matter placed in the OD membership and you will accumulated focus savings do not alter the principal part of the EMI.