There was however an importance of american cash loans Mount Dora FL low-priced credit

A dirty, bodies declaration regarding the later sixties also provides particular understanding of as to the reasons banking institutions and credit unions was able to soundly coexist for a long time, just before their relationships originated with the a few legal actions and you may loads out-of identity-calling.

Depending on the declaration served by the fresh new Public Defense Management, and that oversaw new Agency away from Government Borrowing Unions, the fresh forerunner to help you today’s National Borrowing Partnership Administration, the average equilibrium within the a cards relationship family savings within the 1967 is $549. During the time, borrowing unions, being tax-exempt, merely provided offers account and short individual fund so you can low- and middle-money participants who were connected because of the a common thread – normally an employer otherwise relationship – and more than financial institutions don’t see all of them since the competitive dangers.

By contrast, the lending company out-of Italy, and therefore A good

However, originating in the middle-1970s, borrowing unions steadily extended the list of services they offered, as well as their sphere regarding subscription, most of the for the true blessing of the federal regulator, the fresh new NCUA. Now, borrowing from the bank unions matter more than 110 mil someone since the participants and hold deposits totaling $step 1.step one trillion. They are biggest members in vehicles and you will financial financing and are usually and then make deepening inroads towards the industrial and brief-providers financing.

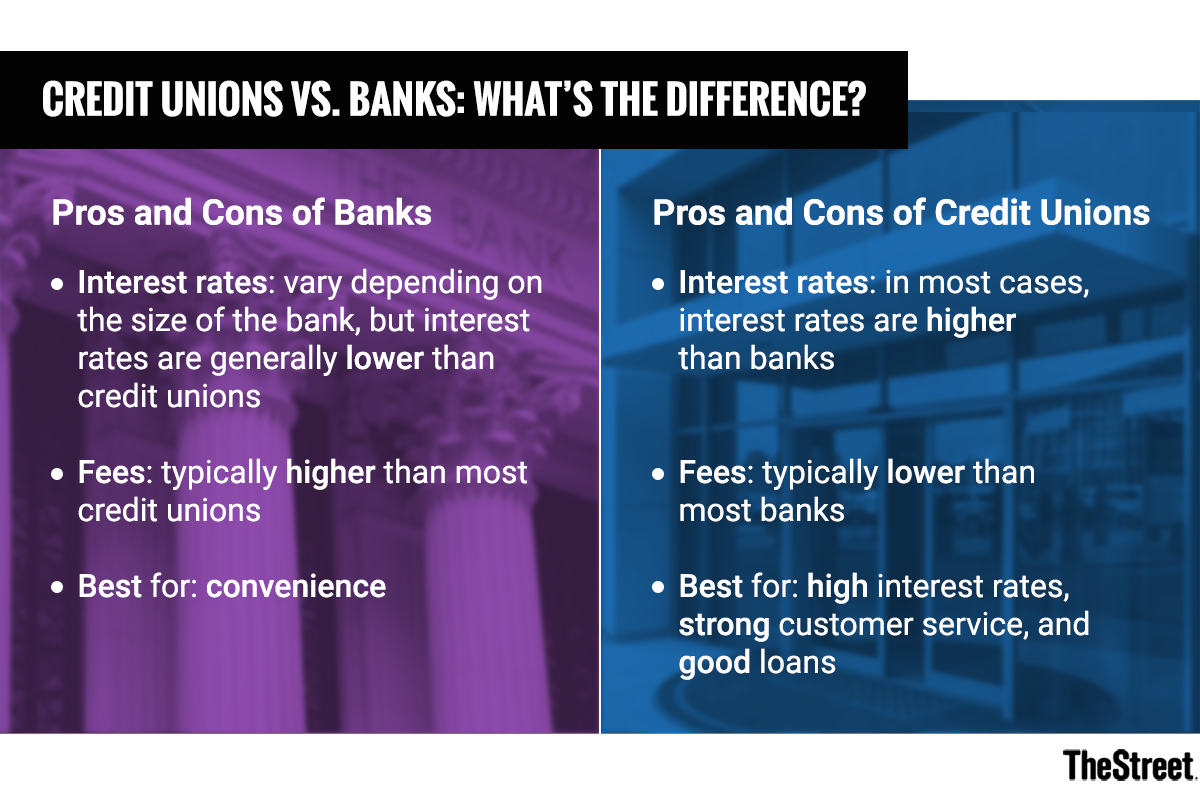

While the borrowing unions have come to look increasingly such as for example finance companies, bankers as well as their change groups keeps expected as to the reasons they are excused regarding expenses federal taxes.

Credit unions keeps countered they have resided correct on the goal by-passing the latest deals to their users on particular highest cost into dumps and lower cost on money. It compete, also, that it doesn’t matter what high particular borrowing unions have become, the cooperative design justifies this new tax difference.

Its an extended-running argument who may have merely heated lately immediately after a prominent U.S. senator expected whether the taxation difference nonetheless produced experience and you can a federal legal influenced for and you can against borrowing unions into the a suit submitted by the lenders one challenged borrowing from the bank unions’ capacity to expand.

What follows is a peek at how credit partnership income tax exception was created and how it has got endured for lots more than just a good century whilst credit unions’ enterprize model changed.

Credit unions in the usa trace their root to help you Manchester, N.H., during the 1908, if Los angeles Caisse Populaire Ste-Marie try established to incorporate first monetary qualities so you can French-Canadian millworkers utilized by Amoskeag Mills.

New beginning from Los angeles Caisse Populaire Ste-Marie, now named St. Mary’s Lender, stuck the interest off Massachusetts’ financial commissioner, Pierre Jay. Informed by the French-Canadian writer Alphonse Desjardins while the department store magnate Edward Filene, Jay drawn up new Massachusetts Credit Partnership Act, and that became law inside the 1909.

Both Filene, which pioneered the latest bargain basement retailing concept, and you can Jay carry out input much of with the rest of its careers so you’re able to promoting the financing union course. From the early 1930s, 38 states had entered Massachusetts in the starting borrowing partnership charters.

In spite of the organizers’ perform, credit unions remained a relative backwater about monetary qualities world, despite their taxation exclusion. Because of the mid-1930s, it measured merely 119,000 people and you may scarcely $2.2 billion away from deposits.

P. Giannini mainly based during the Bay area inside the 1906 with a purpose comparable to help you La Caisse Populaire’s, had more than $350 million out of dumps within the California by yourself because of the late 1920s. (Lender out of Italy is renamed Bank off The united states in 1930.)

Inside arguments before enactment of Federal Credit Commitment Act, Congress projected you to definitely private, high-attract loan providers had been credit on the $2 mil a year to help you lower-earnings consumers.

The initial credit unions were owned and you may managed because of the its participants, who had been tied together by a virtually well-known thread, usually an employer otherwise an association. From inside the St. Mary’s case, people was in fact and parishioners in the St. Mary’s Catholic Church within the Manchester’s French Slope area.