Within this week’s banking development roundup: The fresh Federal Financial Financial of the latest York paid off its departing director off assortment and addition $561,600 shortly after an external review discovered ”supervision things” one led to a-shake-right up of the bank’s hr agency; CDFI Amicable America launches an on-line mapping program to spotlight growth possibilities all over the country; globally law practice A&O Shearman develops its U.S. personal debt money class; and more.

New york FHLB will pay $561,600 to leaving lead away from diversity and you can introduction

New Government Home loan Lender of new York said for the a great filing to the Securities and Change Commission this provides paid off $561,600 to Edwin Artuz, their chief administrative officer, director out of variety and you will addition and you may elderly vice-president of the financial, exactly who prevented operating on bank towards the July step one.

Jose Gonzalez, new district’s chairman, told you inside an interior memo so you’re able to group acquired by Western Banker one Artuz leftover the brand new area after ”oversight circumstances” have been uncovered because of the an external remark.

”An external report on our Recruiting Agency known oversight facts that need to be treated, necessitating an effective restructuring of one’s category,” Gonzalez had written in order to group this past seasons announcing group alter.

A spokesman into the bank mentioned that a review of this new recruiting institution got ”understood options having restructuring and you can modernization.” -Kate Berry

Online device spotlights development opportunities inside CDFI deserts’

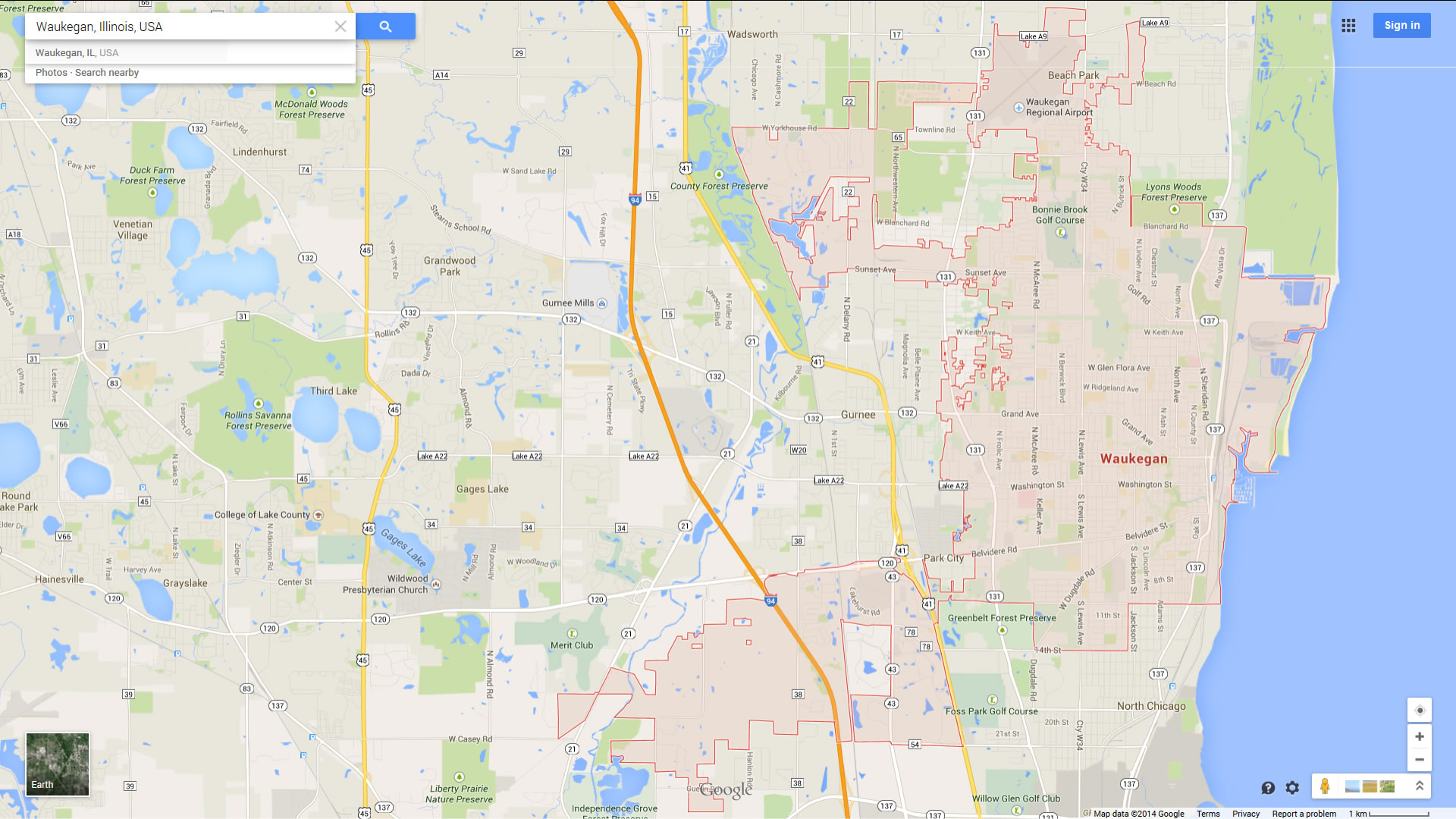

The latest equipment – intended for CDFIs, lenders, bodies, philanthropists, feeling traders and regional officials – allows you to spot the market industry potential for CDFIs everywhere on the You.S. ”What is really distinguished would be the fact so far, men and women knew one to CDFIs (and you may banking institutions) were not reaching some places. Today we realize you can find 1,292 CDFI deserts over the U.S. and we make suggestions in which he or she is, right down to the latest census area peak,” told you CDFI Friendly America’s president, Draw Pinsky.

, the fresh $twenty seven million program produced by the fresh Rising prices Prevention Operate, because of the identifying ”Justice40” section that are the answer to the application. -Traci Areas

A&O Shearman grows its You.S. loans fund party

– shaped in the 2024 via the merger off historical businesses Allen & Overy and Shearman & Sterling – established towards the Tuesday the fresh employing from Alyssa Simon due to the fact somebody in its You.S. personal debt financing routine found in the company’s Ny place of work.

”Alyssa’s expertise in large-give financings bolsters all of our newly joint company’s condition due to the fact a one-prevent shop for the kinds of leveraged financings in the business,” told you Jake Mincemoyer, the brand new company’s globally co-head out of loans money, for the a press release.

Simon first started their particular field from the a major in the world lawyer just before transferring to a prominent capital financial, where she stored some jobs. ”I am thrilled to be signing up for the the party in the A&O Shearman,” Simon said regarding the discharge. ”The brand new company’s globally started to, its skilled people and its particular most useful tier customer lineup is good great fit to own my behavior.” -Traci Areas

Wells Fargo uses TD’s Fadi Aboosh for economic sponsors category

Wells Fargo has hired Fadi Aboosh away from TD Securities while the an excellent dealing with manager within the financial sponsors class targeting structure financing, predicated on people regularly the condition.

Aboosh usually sign up Wells Fargo’s corporate and financial support financial after a good chronilogical age of get off and additionally be located in Ny, told you people, exactly who questioned to not ever feel understood sharing private pointers. He’s going to are accountable to Malcolm Price, the bank’s head out of financial sponsors, it said.

Aboosh are of late a regulating manager into the TD’s financial sponsors category. He registered the new Toronto-founded capital lender last year together with has worked in financing syndications and leveraged finance teams, based on their LinkedIn character.

Wells Fargo, which has been towards a hiring spree to strengthen its business and you can funding financial, also earned Sam Chaturvedi given that a managing director in the financial sponsors out-of Lender out-of Montreal this year. Valida Pau, Bloomberg Reports

Goldman’s deputy head for Asia device actually leaves to participate HSBC

Goldman Sachs Group’s deputy head for a china tool try leaving for HSBC Holdings, the following elder exit about U.S. bank’s China operations this year, some one familiar with the problem said.

Lu Tian, deputy standard director off Goldman Sachs (China) Securities, tend to replace Irene Ho, who’ll retire because President and general director out of HSBC’s ties providers in Asia, individuals said, asking never to end up being known in advance of an announcement.