Where to find the best pond financial support for your requirements

Unfortuitously, starting a call at-ground share can cost you more $fifty,000 typically, which actually leaves of many property owners thinking how to secure pool resource from inside the the original lay.

Exactly what are your options without having enough dollars? Was share financing readily available? Luckily for us, sure. You have loads of a means to buy a swimming pool. Here you will find the best pool financial support choices to look at this seasons, focusing on leverage your residence’s security.

What is pond money?

Regardless if you are seeking created a new inground pond, change your existing pond, otherwise perform a gorgeous garden retreat having landscape, pond financial support offer the funds you want. With multiple loan offers and you can repayment conditions, pond financing allows you to pass on the expense of any project through the years, therefore it is more down and you will reasonable.

Kind of pool finance

A pool mortgage is a kind of financing that’s particularly built to let loans the construction otherwise having a move pond otherwise health spa. Pond financing are often used to safeguards the expense of good form of pond-associated expenses, for example excavation, land, pool products, and you can set up costs.

Secured versus. unsecured loans

- Secured loans, such house collateral funds or HELOCs, require that you make use of household as the guarantee, that will end in lower interest rates and better financing wide variety.

- Personal loans, including unsecured loans, don’t need collateral but generally incorporate higher rates of interest and lower mortgage number.

The choice ranging from covered and you can signature loans relies on activities instance as your available domestic guarantee, exposure threshold, and you can total finances.

Repaired vs. varying rates

- Fixed-speed fund care for a routine interest in the financing title, taking balance and foreseeable monthly premiums.

- Variable-price funds have rates that can change based on market standards, potentially leading to alterations in your monthly payments.

When deciding on between fixed and you will varying pricing, think about your financial requires, chance tolerance, and capacity to conform to prospective payment change along side life of one’s pond mortgage.

Ideal pool investment choice

But wait, beforehand coming up with pond floats and you may making plans for your first party, there is an option step you ought to think: tips finance a swimming pool, just? Don’t worry; it is far from as the challenging as it can look. Let’s diving on various ways you may make this fantasy a reality without breaking the bank.

1. Cash-aside refinance to fund a pool

Refinancing involves replacing your financial which have good new one. You could commonly refinance to acquire a lowered rate of interest and decrease your payment per month.

Based on how far family guarantee you really have, you are able to find cash return once you re-finance. You can utilize the money regarding goal, including debt consolidating, do-it-yourself resource – and you can yes, even strengthening a share.

Positives away from a finances-away re-finance

The benefit of a money-aside re-finance would be the fact you are able to acquire to 80% of home’s security. If you have met with the domestic a while, otherwise made a massive down payment, that would be really to invest in an alternate share on apparently low interest.

- Increase or reduce your mortgage name

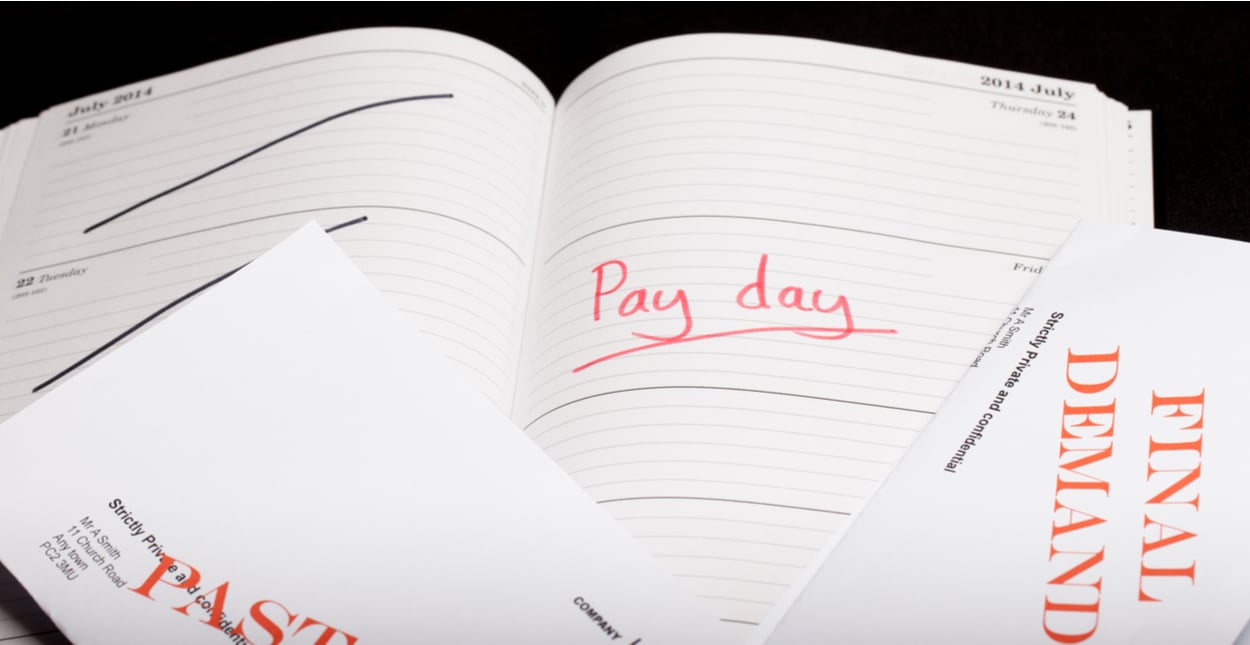

- Key out-of a changeable-price home loan in order to payday loans South Woodstock a fixed-rates financial

- Option from 1 financial system to another

- Eradicate a great co-debtor regarding mortgage

- Treat home loan insurance rates

If the a lender provides you with the lowest financial rates, cashing aside might be the best bet to have property owners with enough equity to create a share. When you can capture cash out and drop your own rate, it’s a huge profit-earn.