Have you been convinced you might purchase a great fixer higher? When you’re very in search of a property that might need particular performs, you need to know that there exists higher choices for this. Your dream domestic tends to be one which only means a small TLC. Prior to any ine both the house and your goals and you may potential. Listed below are 10 points to consider before you decide to purchase a great fixer top:

Thought step 1: Remodeling property yourself would be a great idea, however you should be willing to input most, if not completely, time to that particular repair. Before making one ultimate decision and there is zero supposed right back, inquire whether you are able to undertake work. Their weekends might possibly be spent sanding and you will painting for just what could be a long time.

Idea 2: Determine what is very incorrect on the domestic. Build a list of everything you our house needs fixed otherwise updated. It’s something in the event your household means cosmetics repairs like substitution cupboards otherwise refinishing hardwood floors, as these something should not break your budget. Particular cosmetic transform usually can be performed yourself if you are handy.

Consideration step three: Structural items including the roof, base, or drainage assistance could cost a fortune to fix, so be sure to read the house’s build and significant assistance. Should your house is trying to find much throughout the way of structural solutions, you could reconsider your decision to find good fixer upper.

Consideration 4: Where would you real time although you remodel? When you have elsewhere you can alive as you create home improvements, the concept to buy an effective fixer top might possibly be a good idea for your requirements. On top of that, if you would like immediately are now living in the house their buying, this can be difficulty. In case your home actually livable instantly, be aware that residing in a lodge for an excessive period if you find yourself you will be making solutions and you will updates doesn’t only become a hassle, but it can be very costly.

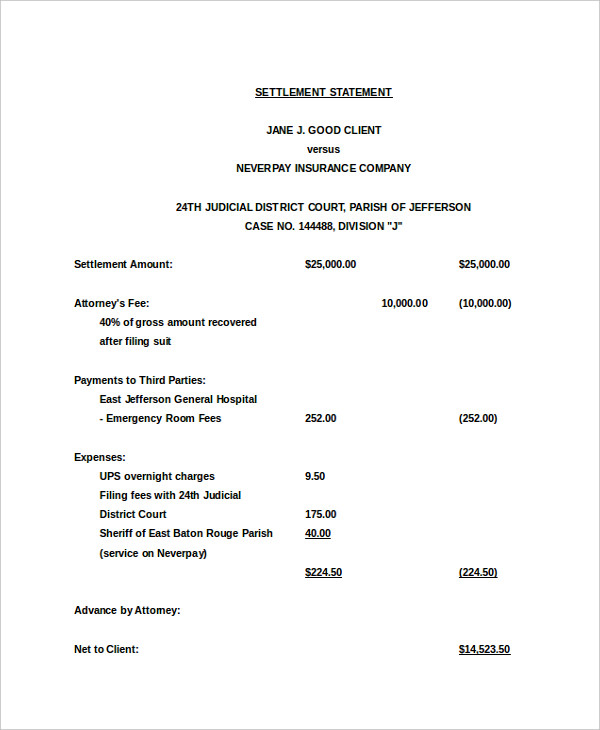

There are two main brand of 203(k) finance, a simple mortgage and you will a sleek mortgage

Attention 5: You need to know when to hire a company and make sure you get the right one. You really need to take the time and you can perform comprehensive search just before employing builders for your house repair needs. When choosing, leave you choice away from a listing of no less than around three builders. It is important to question them for many references and you will advice of the early in the day performs. Never ever capture a company within their word in the place of viewing research, and always rating rates and you will plans in writing in advance of they begin work at the home.

Believe six: Be truthful which have on your own. Was remodeling a property very within your budget? When you’re desperate for the income to own an all the way down commission, the choice to purchase a fixer higher may possibly not be the new best for you. Even although you have you money set aside, might usually you would like more to have wonder factors. However, there are resource possibilities which may decrease the quick prices load regarding remodeling a house.

This might be perhaps one of the most considerations you must know if you are planning to find an excellent fixer upper. A 203(k) financing covers the price of the house and you will one fixes the newest house may require. A deposit of step three.5% of residence’s projected value article-renovations will become necessary. The product quality financing is for land which need architectural fixes and you may the fresh new streamline is for homes that need solutions that will be non-structural.

Idea 8: Have a look at your own service program. Remodeling a house can be extremely stressful when you find yourself carrying it out due to the fact a family group, and more and if you’re doing it solamente. You really need to has relatives otherwise loved ones as you are able to believe in in the event your project becomes stressful.

Said 7: Consider making an application for loan places Manasota Key a FHA 203(k) loan

Idea nine: With regards to the result, definitely have sensible requirement. People watch household recovery reality shows towards HGTV and you will assume the sense to-be an identical. It is not reasonable and will merely set you right up having failure.

Said 10: Has numerous household inspectors evaluate the house. Domestic inspectors has actually many years of feel during the looking at a choice of house in the many criteria, therefore their options comes in helpful before you sign one thing. Taking 2 to 3 inspectors to see our home will guarantee one zero major problems is missed.

Happy to buy? If you believe today may be the go out, label certainly one of NLC Loans’ Individual Mortgage Advisers at the 877-480-8050 for a no cost, no-chain connected financial appointment so you’re able to talk about your property money selection.