To shop for a property is one of the most tall investment you produces. For some homeowners, you to definitely highest off a buy means money when it comes to a home loan. But once you have made your purchase, your own mortgage payments start working for your requirements as you generate collateral of your house. Household guarantee are leveraged by firmly taking away a home collateral financing, called a moment home loan.

These two monetary products have become equivalent, but there are distinctions, especially in repayment conditions. Why don’t we learn the similarities and you can differences.

Key Takeaways

- Home guarantee loans and mortgage loans each other play with assets since equity to possess a secured financing.

- Home security funds are typically fixed interest rates over a period of 5 to 30 years.

- Mortgage loans will be fixed cost otherwise varying costs.

What exactly is home financing?

Home financing is an installment mortgage regularly get a home. You can find different kinds of mortgages, in addition to conventional money supported by banking companies, and you will finance backed by the newest Government Housing Administration (FHA), the fresh new U.S. Department of Pros Issues (VA), in addition to U.S. Institution from Farming (USDA).

Mortgages can have sometimes fixed rates otherwise varying cost. Adjustable-price mortgage loans (ARMs) to switch the costs towards the a set agenda. Such, good 5/step one Sleeve has the benefit of a fixed speed with the very first 5 years. Then, the pace will to evolve yearly before loan is actually paid off. There are many sorts of Fingers, so be sure to understand the regards to your arrangement.

Warning

You truly need to have at the least 20% collateral of your house become acknowledged having property security loan. When you have an interest-just loan, very first 10 years may well not build any equity to borrow against down the road. Equity can nevertheless be depending by improving the value of the house, both courtesy improvements otherwise sector movement.

What’s a home Equity Financing?

A home collateral financing try financing no credit check installment loans in Early secured by collateral manufactured in your property, both by simply making home loan repayments otherwise from the enhancing the worth of your residence. Family collateral fund are usually entitled next mortgages as they function in a really comparable ways. Both are installment loans safeguarded of the property, and in the big event out of nonpayment, the financial institution tend to grab the home to settle the loan.

In lieu of home financing, property security mortgage is actually paid when you look at the a lump sum payment of cash. The money may then be used to purchase some thing. Some typically common spends was to have renovations, paying off highest-desire obligations, otherwise financing a vacation, relationships, otherwise studies.

Exactly how Are House Security Financing and you will Mortgage loans Comparable?

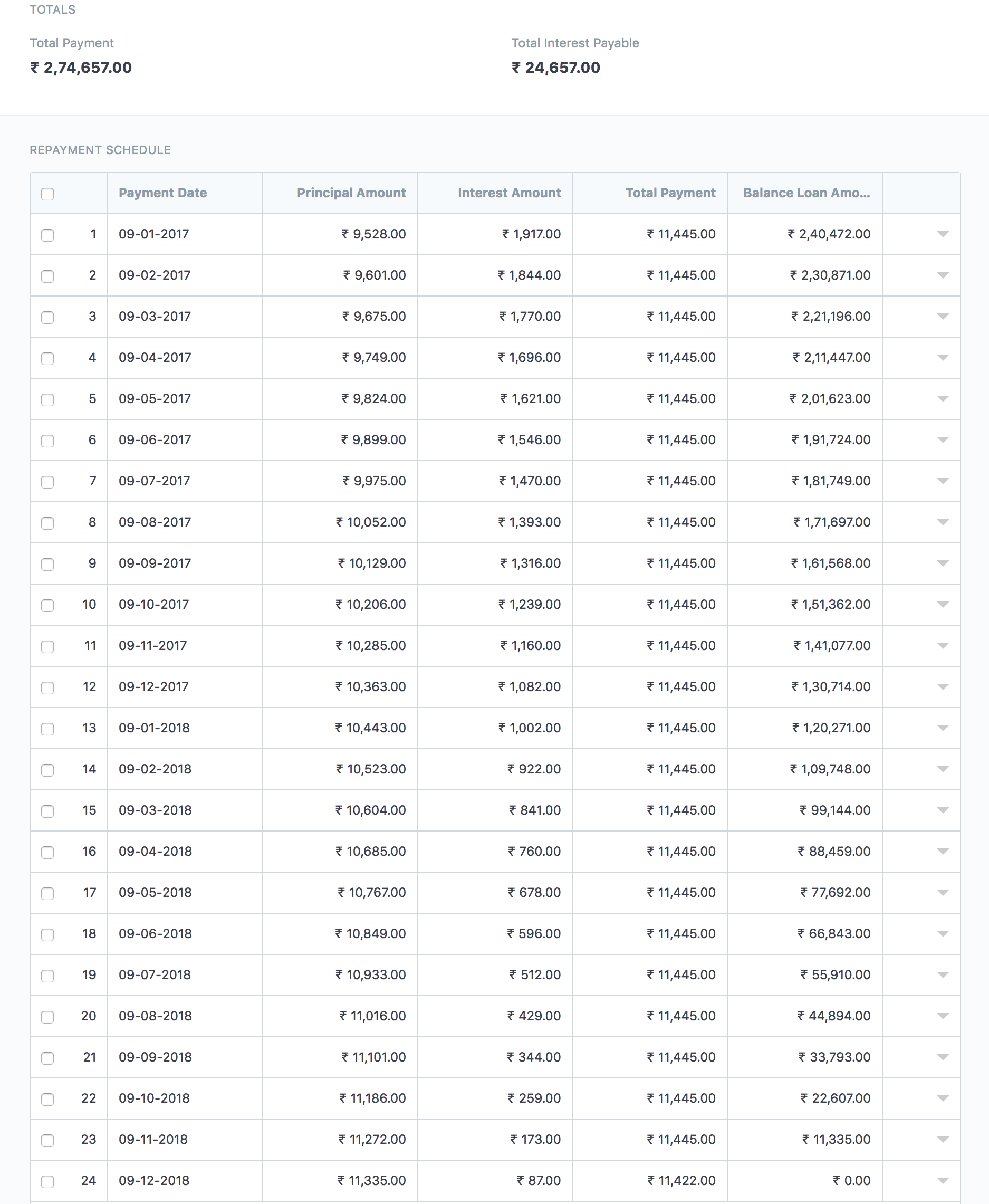

Both family guarantee financing and you can mortgages was paid off on a fixed plan. The most famous payment symptoms for mortgage loans is fifteen and you may 31 decades, however some lenders offer ten- and 20-season words as well.

House collateral finance vary regarding five so you’re able to three decades off fixed money. Its quite strange to locate variable-rate domestic collateral money.

Both sort of financing also can happen settlement costs particularly appraisals, file fees, notary fees, and you can origination costs. Specific lenders often waive some charges to own family guarantee financing to help you ensure it is more attractive for individuals.

Just how Was Domestic Security Fund and you can Mortgages Different?

When you’re family guarantee fund and you can mortgage loans have become equivalent, you will find secret distinctions. The very first is regarding the interest. Household security fund generally have a somewhat large rate of interest than just a primary mortgage. Since domestic collateral money are thought next mortgage loans, if you’re unable to help make your costs, our home could go on the foreclosures to meet up with the debt. If the financial sells the house, it will use the proceeds to blow an important home loan first right after which fool around with people way too much to spend your house security financing. Because a secure, they costs way more attract so you’re able to offset any potential loss.

Addititionally there is far more sorts of payment arrangements to possess mortgages. Although the popular percentage term concerns money that are included with money with the their dominating and you can desire, there are also attention-only funds. Interest-just money is actually arranged due to the fact Fingers, and you may borrowers pay just notice to possess a set time period in advance of money change for the more traditional principal and desire style.

Watch out for interest-merely loans whenever you are seeking strengthening collateral for a future family collateral financing. In attention-just months, they do not create collateral.

Do i need to Enjoys a house Guarantee Mortgage if the My Home loan Is actually Paid back?

Yes. Property security loan would depend just on your guarantee, perhaps not whether or not you’ve got a home loan. For people who very own your residence outright, you really have 100% guarantee. That said, youre nevertheless restricted to borrowing from the bank merely 80% of your residence’s guarantee.

Exactly how much Guarantee Carry out I would like for property Guarantee Financing?

Lenders favor which you have no less than 20% equity of your home to grant you property equity loan. You might create equity because of the possibly and then make money or enhancing the property value your house. If your housing marketplace rises, which can also increase your guarantee.

Will there be a minimum Matter You could Borrow against a property Collateral Financing?

This will range between financial to lender, but the majority lenders like to lay the absolute minimum amount borrowed from $10,000. As the domestic guarantee fund will encompass settlement costs and prices for appraisals, it seems sensible to make certain that the total amount you use was worth the charge. Should you want to use your household collateral for a smaller loan or allowed requiring quick figures over the years, you could believe property collateral line of credit (HELOC) instead.

The bottom line

Mortgage loans and you may home security finance have quite equivalent cost terminology. Watch out for changeable-price mortgage loans (ARMs)-your own costs get fluctuate inside erratic markets, incase you choose an appeal-simply loan, you can also miss out on worthwhile security-strengthening date. House guarantee financing promote independency having larger orders and can be figured into the monthly finances in the sense that the financial really does. Choose an expression and payment that fits your financial budget to eliminate defaulting on your duties and you can losing your residence.