A beneficial guideline getting information closing costs so is this: the reduced their interest rate are, the greater amount of could shell out inside factors (which might be utilized in your settlement costs). The greater your own interest rate, the reduced the products.

All the way down Price, Higher Closing costs

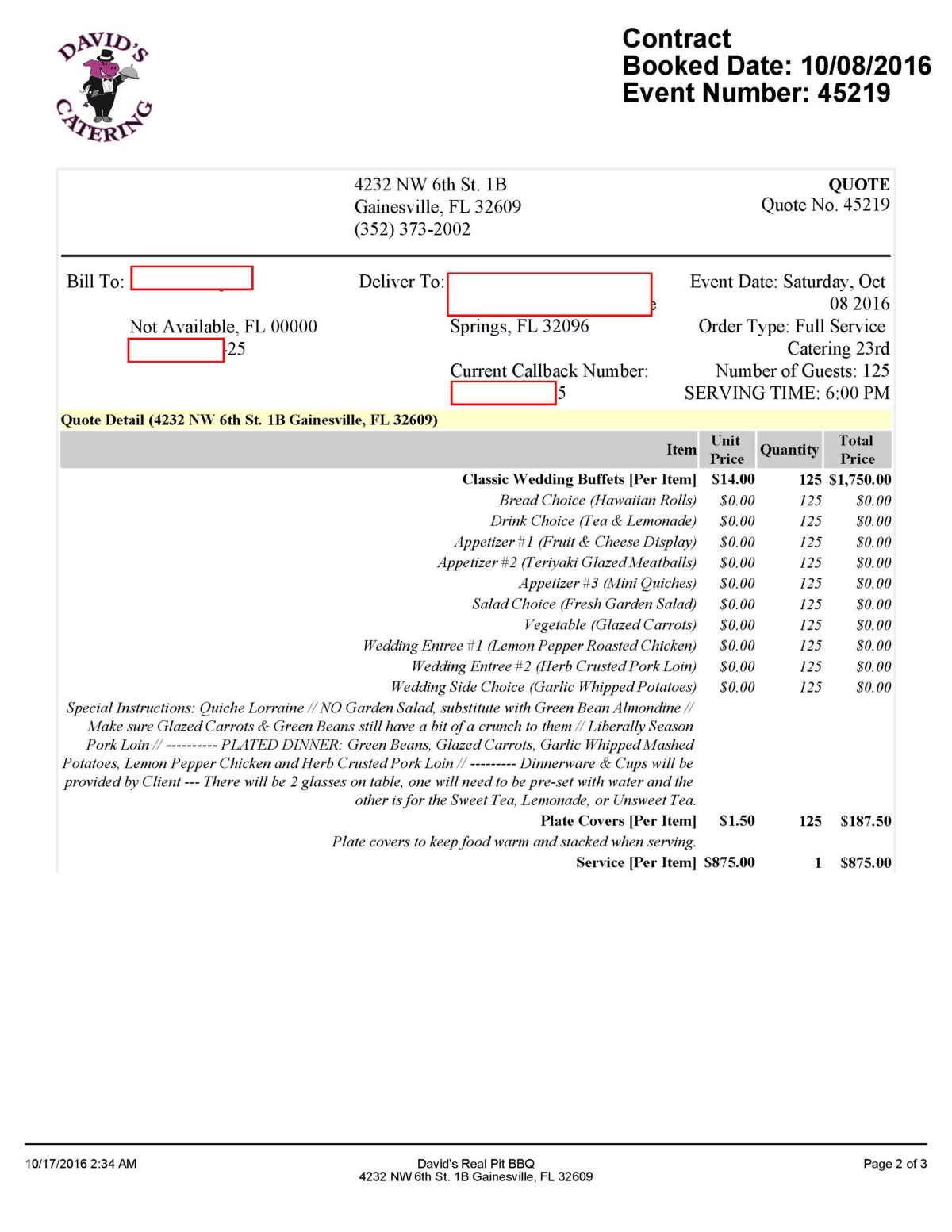

During writing, the common Utah home loan rates is actually 6.105%. Speaking of *samples of real rates. You can view the low the rate offered, the greater the latest closing rates.

*Rates more than is an example, and are also not associate away from today’s prices. Please view today’s cost with the help of our Select The best Speed Device .

Higher rate, All the way down Closing costs

On the other end of your own spectrum, you can find exactly how closure that have a higher rate is also substantially bring your settlement costs down.

*Cost significantly more than is a good example, and are not associate out-of the current pricing. Excite look at today’s costs with this Pick Your very best Rates Unit .

Sometimes, for people who agree to a high adequate rate of interest, it is possible to get closing costs purchased your, or work as a credit on your loan. This new downside throughout these facts was a higher level and you may month-to-month payment.

*Costs significantly more than was an example, and are maybe not affiliate off the http://www.availableloan.net/installment-loans-ia/early/ present prices. Delight check the current rates with our Pick Your best Speed Device .

Do not estimate settlement costs. I show just what they’re going to feel whenever make use of our very own tool.

seven Approaches for Settling Your Closing costs

There’s no phenomenal terms such as, Reducio! that really works in order to shrink their settlement costs. Nevertheless these information can assist browse your residence to invest in feel therefore you are sure that you’re no less than acquiring the lowest price you’ll be able to.

step one. Research rates : Receive numerous mortgage rates out of more loan providers examine settlement costs. This will help you choose and this bank provides the most readily useful terms and you can lower fees. Make sure to examine pricing about same day, and you may exclude such things as escrows & prepaids (due to the fact not all the lenders were all of them, and they will become exact same wherever you close their loan).

dos. Ask How will you allow us to out : Specific closing costs has actually go area. Query what they does about how to all the way down fees, such as for instance mortgage origination costs, disregard things, appraisals, or underwriting fees.

step 3. Inquire owner to own concessions : Whenever you are to buy property, it creates sense so you’re able to discuss toward supplier getting them buy a portion of your own settlement costs. That is likely to occur in a consumer’s business. Pose a question to your bank otherwise real estate agent whenever they would encourage otherwise discourage it in accordance with the condition.

cuatro. Request to shut at the conclusion of the newest day (whenever possible) : By arranging the closure by the end of your own day, you could potentially slow down the amount of prepaid notice, known as for every single diem attract, that is required at closure.

5. Favor an effective no-closing-cost financial : Some loan providers provide mortgages where you favor a high rate one covers your settlement costs. It isn’t very a no-closure prices financial, these are generally simply covered by your own borrowing from the bank towards interest. You usually like this option if you think pricing goes lower prior to their split-even point. You are putting on a top disease regarding the short-name, but you might be trade one to getting a faster good financial burden during the the brand new much time-identity, if you don’t re-finance to help you a lesser price.

six. Inquire once they make discounts available to have bundled features : Certain lenders and you will title organizations make discounts available if you are using their associated qualities, eg title insurance coverage or escrow functions.