Maximum credit limits to possess enhances are very different from the FHLBank, but aren’t fall anywhere between 20% and you may sixty% regarding complete possessions. Affiliate advances charge repaired otherwise drifting pricing across the a great list of maturities, out-of immediately in order to 3 decades. According to the newest FHLBank Workplace regarding Money individual presentation, floating-price improves comprise just more 30% out of total enhances by . New readiness away from advances provides shortened together with this particular pattern into a floating rate: More than ninety% from improves decrease when you look at the quicker-than-you to definitely four-year diversity by the end out-of 2023, a 25% raise more 2021. Whenever you are costs are often times updated and differ around the banking institutions, Profile step 1 lists a sampling regarding rates by .

As of , 580 insurers was basically people in the brand new Federal Home loan Financial (FHLBank or FHLB) program and had lent more You$147 mil from it season up to now. step one Insurance company involvement about FHLB system myself aids FHLBanks’ ongoing purpose to provide sensible lending to help you home-based mortgage individuals. FHLBanks provide to help you insurance firms at extremely aggressive costs, undertaking possible possibilities to incorporate money or promote give because of the borrowing at low cost and you will investing in risk-compatible segments. When along with you can easily favorable procedures from product reviews businesses, we feel this choice deserves thought because of the All of us insurance vendors.

In the symptoms out-of market fret, insurers are usually maybe not compelled to become suppliers, that offers help so you’re able to funding places, your house mortgage plifies insurance-providers capital yourself financing field because insurers are essential to overcollateralize its enhances, or fund, regarding FHLBanks that have home-based financial-associated expenditures

Brand new FHLBanks was regional cooperatives out of lenders had and you will governed from the its six,502 professionals, which includes commercial banking institutions, offers and you will loan organizations/thrifts, borrowing unions, community development financial institutions, and you can insurance vendors. One entity appointed since a lending institution beneath the Federal Domestic Financing Lender Act out-of 1932 that is when you look at the a great financial condition, and that owns otherwise circumstances mortgages or financial-supported securities, is approved for membership. 2 Insurance firms, a great deal more especially, need to be chartered from the and you may regulated within the regulations out-of an excellent condition.

Insurance agencies was in fact eligible for FHLB membership given that FHLB system’s inception, which is proof their strengths into the housing market and you can to the FHLB mission to render credible exchangeability to help you member establishments to support construction fund and you will neighborhood funding. 3 Today, approximately United states$step one.2 trillion, or fifteen% of insurers’ spent possessions, are allocated to domestic financial-related investment. cuatro Insurance agencies, owing to such opportunities, is actually exchangeability business to the home loan-backed ties (MBS) field, which stimulates discount getting private residents. Not just do insurers keep financial-associated expenditures, they are also largely able to keep men and women assets over the lasting. The new FHLB advance system is, within take a look at, a significant product in service out of FHLBanks’ dedication to support construction money and you can society development.

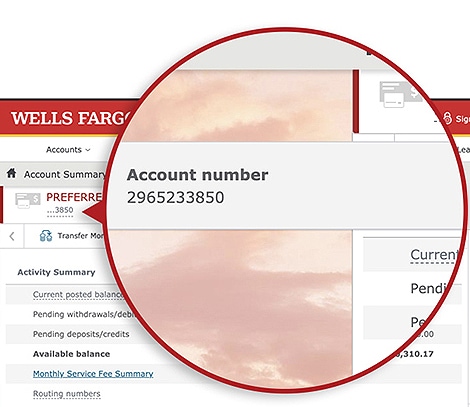

Immediately after businesses has actually satisfied the fresh new subscription standards, they’re able to make an application for a secured mortgage, referred to as a keen advance from the FHLBanks

In person and also as a whole, FHLBanks try liquidity organization; they extend glamorous resource so you can associate companies who in turn promote money so you can home owners. Regulators service as well as the undeniable fact that each lender are in charge perhaps not just for its own obligations but compared https://paydayloancolorado.net/vineland/ to all lender inside the device are what let the FHLBanks to pass through into the prices offers so you can people.

To become a part, a place need to: (1) satisfy the very least carrying threshold to possess residential MBS; (2) pick FHLB stock; and you will (3) see particular borrowing-rating metrics of FHLBanks. Membership was taken out and you can handled during the holding-business peak. The region in which a keen insurance carrier performs their prominent span of team (age.g., the spot of one’s panel otherwise manager class) normally identifies one to company’s regional or home FHLBank. The degree of FHLB stock required to be purchased may differ around the FHLBanks, however, usually is actually a small percentage from a keen insurer’s invested property. FHLB stock isnt in public areas replaced but could feel redeemed for par at the giving lender under each bank’s conditions.