Two independent payments: You are going to pay one or two money per month to separate lenders. In today’s on the internet banking vehicles-spend world, that is not a problem. Simply developed continual payments.

Being qualified for an 80-10-10 piggyback loan is a little more complicated than for a standard compliant financial. That’s because another home loan is regarded as greater risk, therefore boasts higher cost and much more strict recognition criteria.

And you may, even though you get approved with the no. 1 mortgage, there’s a chance another lending company would not undertake the application.

The minimum credit rating to possess an initial conventional home loan was 620, while some mortgage lenders want an even higher rating. However the 2nd lending company may require a great 680, 700, if you don’t large.

Lenders also check your DTI. When you have high non-homes debts, eg higher bank card stability, an automible commission, and you can an excellent signature loans, they could view you since the higher-risk with the addition of into a couple property finance in addition obligations bunch.

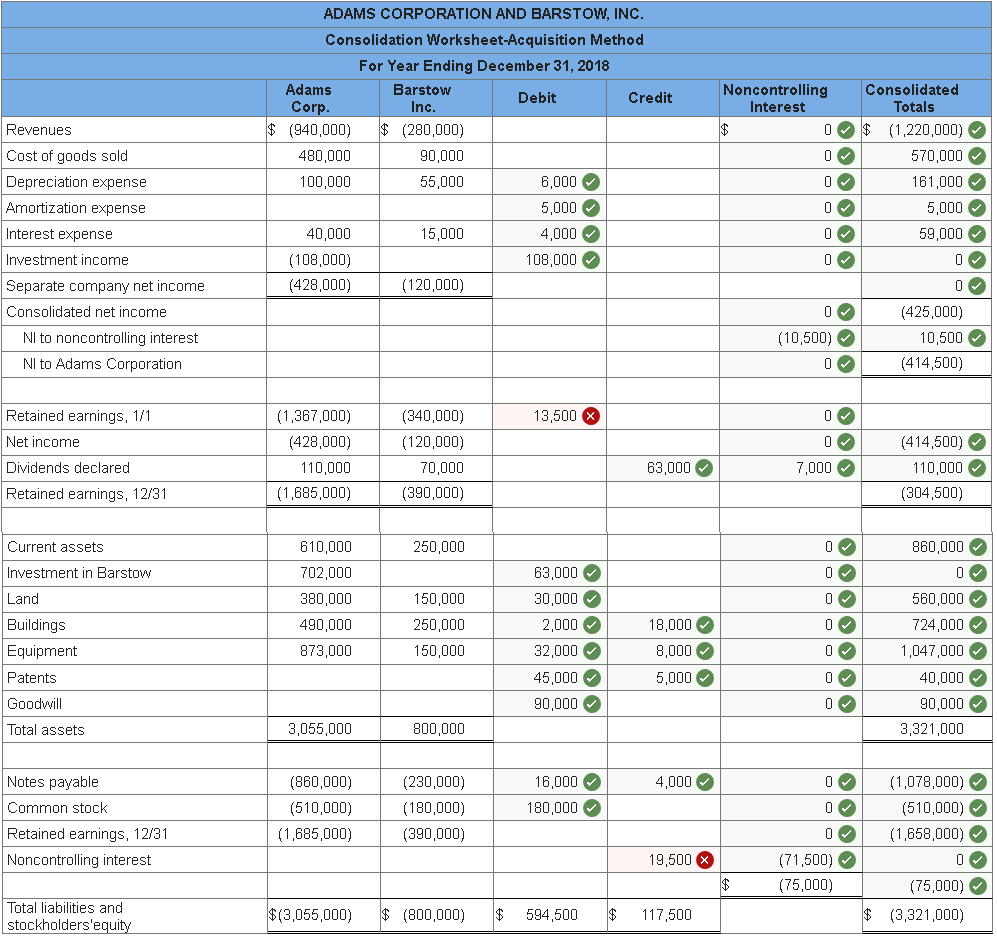

Piggyback finance versus FHA versus Conventional that have PMI

Below is a harsh evaluation of one’s around three financing items discussed. Just click here to find a personalized estimate for every option.

$300k Home Purchase80-10-1090% FHA90% Conv. w/PMIFirst home loan$240,000$274,725 (incl. upfront FHA MIP)$270,000Second home loan$30,000n/an/aHas mortgage insurance coverage?NoYesYesHas 2nd mortgage repayment?YesNoNoThese figures is prices and also for analogy aim merely.

80-10-ten options

If an enthusiastic 80-10-ten piggyback loan is not an option for your, there are many more ways to save. And there are a number of no and you may low down payment mortgage programs that, because they manage possess some variety of home loan insurance coverage, will be the right economic moves in any event.

A traditional 97 loan, as an instance, lets qualified homeowners to invest in a house having 3% down. This new 97 relates to your loan-to-worth proportion (LTV): 97% lent and you may step three% off.

You are going to shell out PMI towards a normal 97 mortgage. But on the flip side, it may be easier to qualify for one financing compared to an enthusiastic 80-10-ten piggyback loan, especially if you has actually a beneficial however advanced borrowing otherwise your DTI is found on the higher end.

And also the at some point you order a property, the earlier might begin to build household security, that is a major cause for expanding the wealth.

Think of, PMI isn’t really forever. You can demand it come off once you achieve 20% domestic guarantee, and be able to make additional mortgage repayments in the event the we would like to end up being aggressive on your payment schedule and you may strike 20% at some point.

When you visited twenty-two%, the fresh PMI needs falls out-of automatically; it’s not necessary to get hold of your lender to help you request it.

- USDA loans: 0% down

- FHA financing: 3.5% off

- Va financing: 0% down to have eligible homeowners that have complete entitlement benefit

USDA and FHA money each other keeps initial and you can yearly home loan insurance coverage conditions. Va funds don’t have annual financial insurance premiums, but there is however an initial financing commission.

80-10-10 loan providers

Don’t assume all financial can do an 80-10-ten financing. It will require accessing next mortgage vendor, which certain lenders you should never. Also a lot fewer lenders is actually educated enough to publication each other fund courtesy the process and personal punctually.

80-10-10 piggyback loans Faq’s

What makes piggyback mortgages named 80-10-ten mortgages? An 80-10-ten piggyback loan translates to: a first mortgage to own 80% of your own deals rate; the next lien to own 10%; and a good 10% advance payment. The following mortgage piggybacks in addition first.

Would piggyback funds continue to exist? Sure, 80-10-10 piggyback loans are still offered. Not all the loan providers render her or him otherwise assists you to use them to pick a home, and if you are seeking this package, ask single payment loans your bank when they give they before you apply. This may even be you’ll be able to to get an 80-15-5 piggyback mortgage, depending on your lender.