2 Virtual assistant Loans

That it second option won’t be readily available for many people, however, people that tend to in fact be eligible for it could be happy in reality.

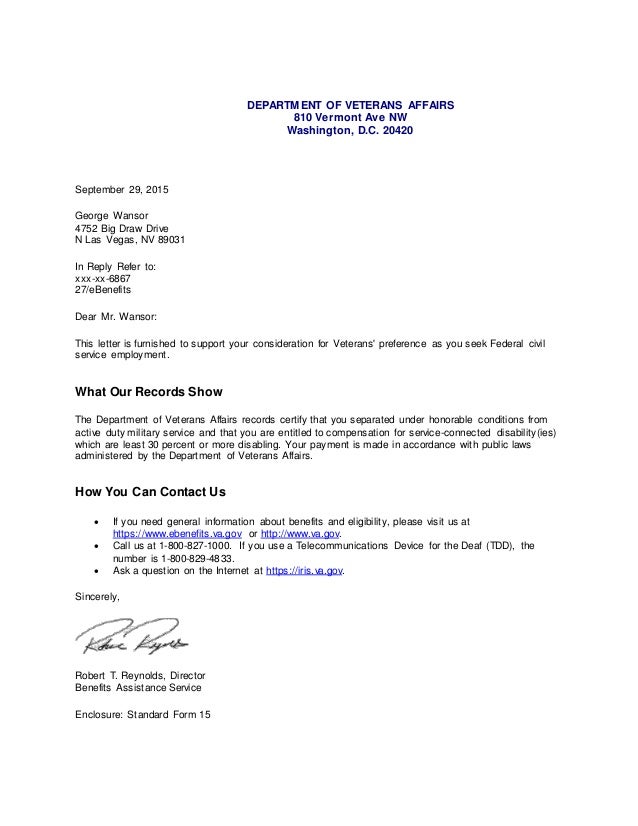

As his or her occupations benefit to have providing the nation, the services professionals and you may pros get assistance from this new Service of Veterans Points when they are interested a home. He’s neither necessary to generate a deposit nor shell out getting home loan insurance coverage compliment of a Virtual assistant loan.

This new Virtual assistant theoretically advises no minimal credit score because of it types of regarding mortgage. However, as start of the COVID-19 pandemic, lenders today like a get out-of 600 or maybe more. Hence, feel told one to as you already have good 600 credit rating, even although you is actually a qualified service associate or experienced, it will nevertheless be hard to be eligible for an excellent Virtual assistant mortgage for the 2021.

step three USDA Loans

If you don’t fulfill the Virtual assistant mortgage requirements however they are thinking off a zero-down-commission financial, there was an alternative choice you can prefer! Which is when you’re willing to purchase property for the an excellent USDA-recognized outlying urban area.

On the upside, all the brand new U.S. is approved for a financial loan backed by the latest You.S. Department of Farming. The region need not be a ranch, hence mortgage is precisely for residential objectives. However, you also have to make certain that you and any loved ones provides a total earnings you to definitely is higher than the fresh new restrict prescribed in the area. They want that it in order to reduce the chances of a possible punishment of the program due to the fact program is designed to assist so much more disadvantaged Us americans.

Having said that, the new USDA loan also does not require at least borrowing score. A beneficial 600 FICO Rating can give you a good attempt, though it will help you to significantly more should you get a credit score away from 640 or more. The application might go into higher scrutiny because of the bank throughout the the underwriting process at the latest get. Whatsoever, 600 is still below the A listing of Credit ratings. They’ll would like to know if you’ve got a default, youre trailing on the other personal debt, or maybe just the reasons why you haven’t acquired increased credit rating.

Bottom line

In summary, it’s okay to feel scared if you’re applying for home financing. Sadly, a lot of us simply sense this after in our lives. However, do know for sure that there are options for you though you may have a lowered credit history.

It’s always far better manage your credit you can meet minimal credit score conditions of the many most useful mortgage brokers in the industry. On top of that, you are getting the most bang for your buck otherwise need to pay higher focus otherwise home loan insurance coverage.

Lastly, it could sound incredible to arrive at maintain your money a beneficial when you find yourself lengthened when they do not require a down payment, keep in mind that the attention can add on right up if you do so. Very go for the fastest go out you can obtain house equity by making a much bigger advance payment. Trust all of us. It should be worthwhile!

For many who constantly pay your own bills and give a wide berth to maxing your mastercard limits, you really have good likelihood of taking good credit. Lenders have confidence in these types of critiques to assume whether or not we will be in control borrowers in the event the accepted getting a separate financing.

Fundamentally, one benefit of getting a keen FHA financing is the probability of taking assistance from down-payment guidance programs. Many people need to pay their downpayment out of pocket, although FHA allows individuals that have all the way down credit to get their down payment away from gives.