Sr. Underwriter | FHA De-, Virtual assistant SAR, USDA

Learning the other 2.15% percentage on my Va mortgage try a startling revelation, including an urgent $8,600 with the price of good $eight hundred,000 assets.

To own experts that has previously used good Va financing, new money fee escalates so you’re able to a more challenging step three.3% when a veteran really does a no downpayment mortgage. It indicates on the same $400,000 amount borrowed, the fee skyrockets to help you $13,200! That charge are on the top of standard financial closure will set you back, appraisal charge, insurance policies, and more.

I remember perception a sense of disbelief and you may frustration, a sentiment We in the future knew try mutual by many people almost every other experienced homebuyers.

While i first discovered this type of fees while using the a Virtual assistant financing for a house get into the Southern California, I found myself astonished. They appeared way too much, almost penalizing. Regardless of the initially wonder, I delved better, uncovering reasons that provided us to go after the Virtual assistant financing getting my personal household during the Tangerine Condition.

New Virtual assistant investment commission was a one-day payment your Veteran, solution representative, or survivor will pay on the a good Virtual assistant-backed or Va head mortgage. This fee really helps to lower the cost of the borrowed funds to own You.S. taxpayers as Virtual assistant financial program doesn’t require off repayments otherwise monthly home loan insurance.

As for my record, We have served as a home loan underwriter for two+ decades-looking at more than ten,000 loans throughout my career-and you can in the morning in addition to a veteran of your own All of us Marines Reserves.

Let this Va financing recipient to walk your by way of why, despite one initially treat, such fund are often an effective choice for pros such as for instance me.

My personal Virtual assistant Loan Feel

That it personal expertise applied the origin having my understanding of Va financing, that we tend to today describe in detail.

Into 2010, my spouce and i moved inside using my in the-statutes shortly after leaving Virginia to return for the Western Coast. Having a baby and you may 2-year-dated baby inside tow, i need an innovative new start close family within our household state of Ca. They assisted you come back to your the feet, and soon adequate https://paydayloancolorado.net/fort-collins/, we had been ready to purchase all of our lay once more.

We noticed and you will opposed one another Virtual assistant and you will FHA finance to-do very, once you understand one another promote reduce-fee options as opposed to others.

Drawing from my procedure of going for ranging from Virtual assistant and you will FHA fund, let’s look into a relative studies to learn the peculiarities.

Comparative Investigation- Researching Va and FHA Finance

In addition, away from a factual view, an assessment of Va and you will FHA financing you can do to help you make an informed decision.

ConsumerAffairs will bring a thorough comparison chart, incorporating depth on the understanding of these loan brands. That it chart offers an in depth breakdown of the distinctions, enabling you to select and that financing might be more desirable for your position.

For every single mortgage method of has the benefit of collection of professionals designed to various borrower requires. The past possibilities is dependent on this conditions each and every individual otherwise family relations.

Va Financing

One to massive difference-and exactly why my children decided on a great Virtual assistant financing-is that they do not require month-to-month home loan insurance rates. Putting off 5% is slashed the fresh new funding payment to a single.50%.

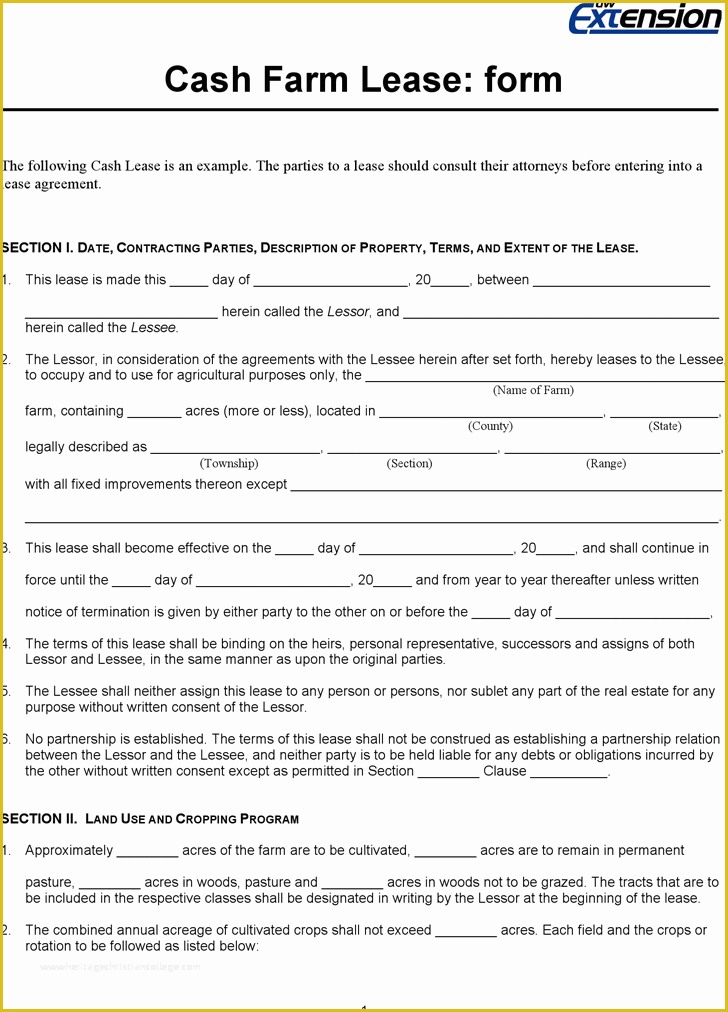

The fresh new table lower than is actually about U.S. Agency from Experts Circumstances website wearing down the various levels of funding fees based on downpayment.

FHA Financing

FHA amount borrowed a lot more than a beneficial 95% loan-to-worth proportion (LTV) need payment off home loan insurance policies for the complete financial title. Such, for those who secure a thirty-12 months repaired home mortgage from the 96.5 LTV ( 3.5% down payment ) monthly financial insurance are expected getting three decades, if you don’t can pay off of the loan prior to.

- Virtual assistant money stand out to own perhaps not requiring month-to-month home loan insurance policies and you will giving straight down capital fees just in case you renders an all the way down payment, making them such beneficial having qualified pros and solution people.

- Additionally, FHA fund, due to their much more easy borrowing from the bank criteria and quicker off costs, should be an even more obtainable selection for a wide selection of homeowners.

Which have looked the difference ranging from Va and you will FHA fund, per financing type enjoys unique advantages and factors. To help aid in navigating such selection and you will focusing on how they you are going to feeling your money, let us today move to specific practical equipment that may promote even more clearness and you will help in decision-while making.