Some borrowers get favor a repayment choice where it work on just paying off the eye (in addition to fees) part of its financing getting a-flat day, normally ranging from that and you can five yearspared to a great P&We loan, the speed offered to possess an appeal only option tends to be high. Once the you’re not building collateral of your home inside attention-only several months, you will pay so much more appeal along the lifetime of the borrowed funds. Although not, attract just will be a stylish choice for possessions people or people to the extremely rigorous costs who expect to be able to pay for high repayments in future.

Owner-Occupier Funds

.png)

You should indicate the intention of your loan when you pertain and you may probably get a better rate if the family loan is actually for a home you want to reside. Owner-occupier money in addition to are apt to have increased restrict LVR, that is ideal to possess first homebuyers incapable of cut a great deposit. Bear in mind, you’ll want to let your lender learn, and perhaps refinance, to eliminate penalties for many who change your notice and determine to help you rent the your house.

Investor Financing

Australia’s financial regulator considers trader money riskier and requirements loan providers so you can keep a whole lot more capital once the a barrier whenever credit so you can buyers. Meaning money buying a residential property will normally have a lesser restriction LVR (e.g., you prefer a bigger deposit) and lead to a top rate of interest. Of a lot trader money is an appeal-merely percentage option, providing traders in order to release income and you will possibly apply out-of bad gearing-in which people can be claim an income tax deduction in case your price of having a house (for elizabeth.grams., attention repayments) is more than the leasing income.

Variable Home loan

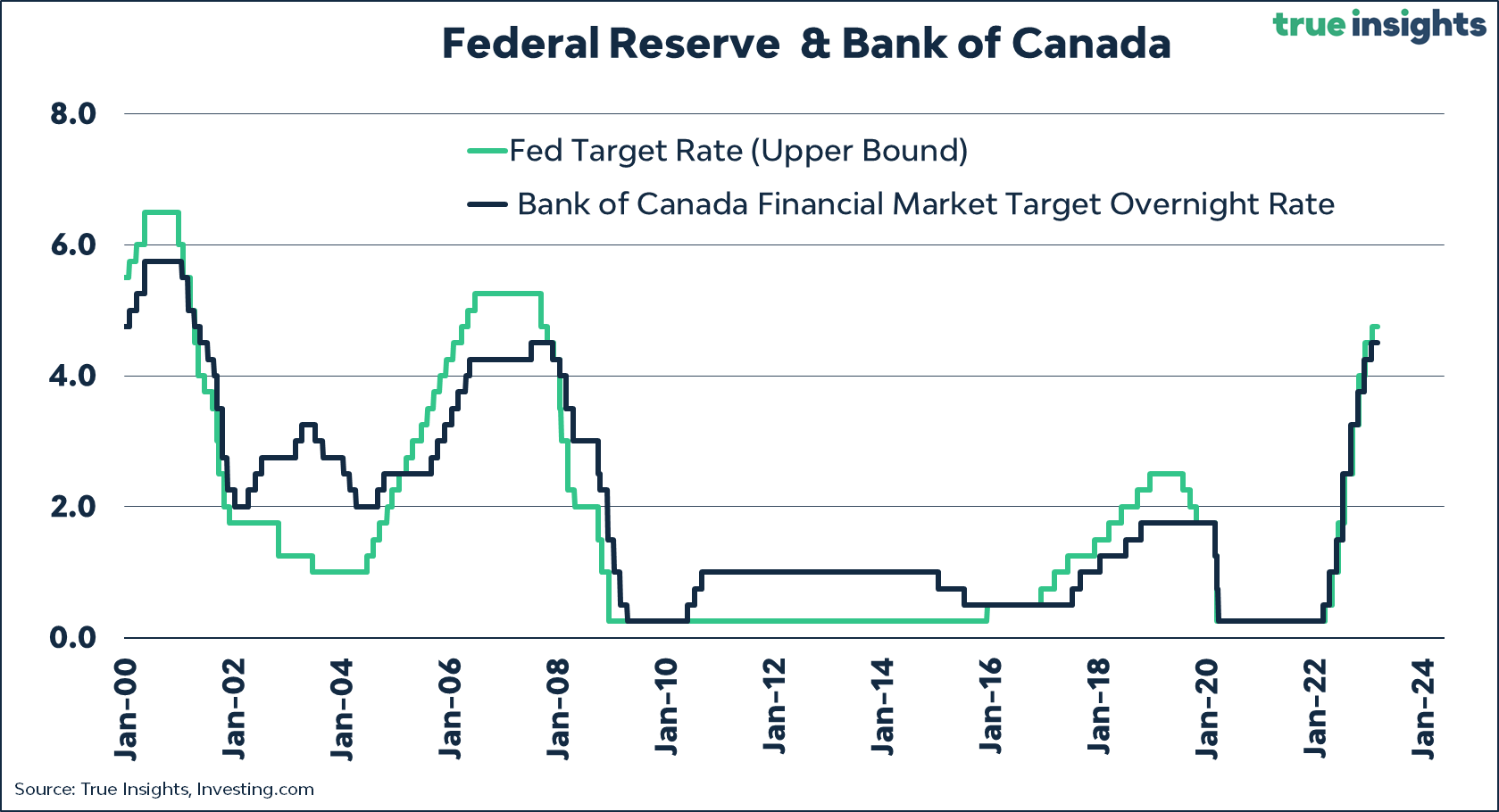

A variable speed loan is the one the spot where the rate of interest billed varies, which means your repayment size develops or decrease accordingly. Adjustable cost was adjusted because of the loan providers founded generally into the formal bucks rate lay because of the RBA, the fresh new lenders’ will set you back away from capital, and you will markets race. Varying price lenders are more inclined to become packed during the ways give borrowers far more features and you will independency-including counterbalance membership, the capability to build unlimited most repayments and you will redraw financing, and connected playing cards online loans in Avon Alabama.

Repaired Financial

A fixed price financial tresses in the a certain interest to possess a time period of to you to 5 years. The beauty of a predetermined rates is you know precisely exactly how much interest you will be charged and can plan for the home loan repayments with confidence. The new disadvantage was, you may be trapped on that rate though variable interest levels lose rather. Repaired rate financing usually have strict limitations into to make extra payments, and no counterbalance account otherwise ability to redraw money from their mortgage.

Split/Mixed Mortgage

Some loan providers will let you divide the loan matter toward one or two portions: with many at the mercy of a predetermined speed and lots of into the a adjustable price. You might create a torn otherwise place the vast majority to a good repaired speed if the rates available is specially reasonable. Busting the loan also provides self-reliance but can produce extra account-remaining charge.

Basic in the place of Package Financing

Loan providers can offer a standalone basic’ mortgage, otherwise a beneficial package’ that generally bundles to one another a range of banking enjoys lower than one to yearly percentage-together with your financial accounts, discounts levels, credit cards and possibly signature loans. Merging your own financial having you to financial could be more convenient and you may possibly costs-productive, and you can a deal financing can also feature a reduced interest rate (as compared to a fundamental alternative in the exact same bank).

- Multiple offset membership. Offset levels are fundamentally discounts levels connected with your financial membership. The money for the offset levels try counted inside your dominating equilibrium if the interest you borrowed from is actually computed by a beneficial lender. It means the loan payments was faster, you could still availableness the savings date-to-big date.