If you’d like to loans their little home with a traditional mortgage, it must be on the a stronger base toward a storyline from home. not, it may be rather hard to find a timeless financial to your a little domestic. Traditional mortgage loans usually are merely a possible manner of capital getting people who have high tiny residential property into a charity or people with high priced, deluxe smaller houses with rate things near to a vintage family.

Land Funds

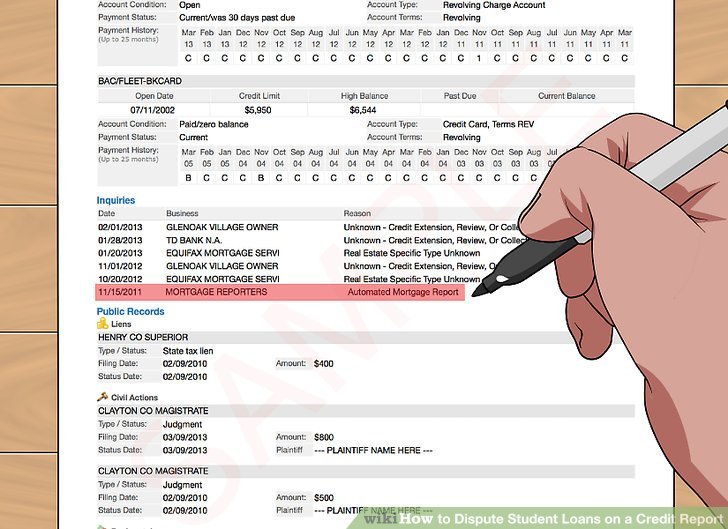

Residential property money perform like mortgages but have larger off costs and rates of interest considering the lack of possessions equity. To be eligible for an area loan, you really need to have a credit rating and a significant portion of your total cost stored due to the fact a down payment. You must also provide reveal residential property innovation intend to encourage lenders that you’re a good investment.

Structure Funds

Whenever you are strengthening your own small household on ground right up, you are eligible for an initial-name construction mortgage that covers the cost of the tailored smaller family. Build funds are designed to help homeowners get started on strengthening a custom home to help you up coming use a home loan to repay our home once this has been done. This technique is one possible cheat for those trying a traditional mortgage who otherwise be unable to secure one.

Tiny Household Builders and Loan providers

Of many small household developers promote their unique money and you can financing apps, which means you won’t need to complicate the credit techniques and wade thanks to other people. Now, there are numerous lightweight household designers to select from receive in any state. Once you decide to funds the generate by way of a little domestic strengthening organization, you will get in order to tailor every sq ft in your home if you find yourself searching financing.

Domestic Guarantee Money

For individuals who currently individual a property and generally are looking to incorporate a new individual tiny domestic area on the house, you’re capable utilize your household equity to get what you need. This strategy is perfect for those building a lot more life style home otherwise offices. Family guarantee mortgage numbers are determined of the deducting the degree of currency your currently are obligated to pay on your own financial from the full property’s worthy of. The greater amount of in your home you reduced, more you could potentially tap into your residence equity.

Family Security Personal lines of credit

If you find yourself property equity loan is fantastic for the individuals shopping for a lump sum payment on a predetermined interest, men and women trying to draw currency because they want to buy will be implement having a house security line of credit alternatively. House security credit lines frequently come with a varying interest online personal loans WV price and enable that shell out within the appeal-only installment payments. If not you prefer a substantial contribution to shop for your lightweight household, a home guarantee personal line of credit is probable a much better solutions than simply a property security loan.

Rv Financing

Lightweight property that will be into wheels and you can run out of foundations is qualified to receive degree and money from the Athletics Car Community Organization (RVIA), which gives Camper funds to little property that are felt long lasting residences. The brand new RVIA ensures that tiny property for the tires (THOW) is actually complicit to the You.S. Agency regarding Transportation’s Federal Roadway Travelers Safety Administration requirements additionally the traditions quarters is actually adequate. You may also obtain Rv fund compliment of of a lot biggest financial institutions and you will borrowing unions.

When you’re Camper finance is going to be difficult to obtain because of strict protection requirements, of numerous makers concentrate on carrying out depending-away RVIA certified small belongings in order to safe a low-attract Rv loan.