This is how link funds are in. They supply the bucks you prefer on deposit upfront so that one can secure a home loan and pay the merchant within the complete.

Yet not, there are lots of cons, also highest-rates. Banking companies may give the money you ought to get your brand new home, however, a short-label link mortgage commonly is sold with a hefty price.

As well as, there’s always a risk loans Daphne that you may not ready to offer your property such a short period of your energy, which could make it considerably more challenging to fund your debt.

Bridge finance normally work at for six months so you can annually. According to your needs, lenders can be flexible, instance throughout the advanced assets deals which need good-sized judge paperwork.

To reduce risk, finance companies safer link financing on the latest money. If you can’t pay off, loan providers can use getting salary garnishment, allowing them to need any money your debt from your own bank membership.

What is actually a connection Mortgage Home loan?

Extremely property owners score a bona fide property bridge loan about lender one to agrees to finance its home loan. He could be a temporary substitute for their financial support means before you can sell your house. Loan providers fees large costs on these fund by the risk that the business usually fall due to otherwise which you neglect to boost adequate money.

Trying to get bridging loans work similarly to a conventional mortgage. Financing officials tend to consider numerous items, including your credit history, credit rating, and loans-to-earnings ratio.

Normally, your own limitation loan-to-worthy of otherwise LTV proportion was 80%. Consequently you’ll want to see 20% of security worth of people family we need to pick one which just obtain the remaining equilibrium.

Therefore, what’s a connection mortgage gonna charge a fee? As previously mentioned a lot more than, link finance are usually costly than old-fashioned mortgage loans because of the increased risk with it.

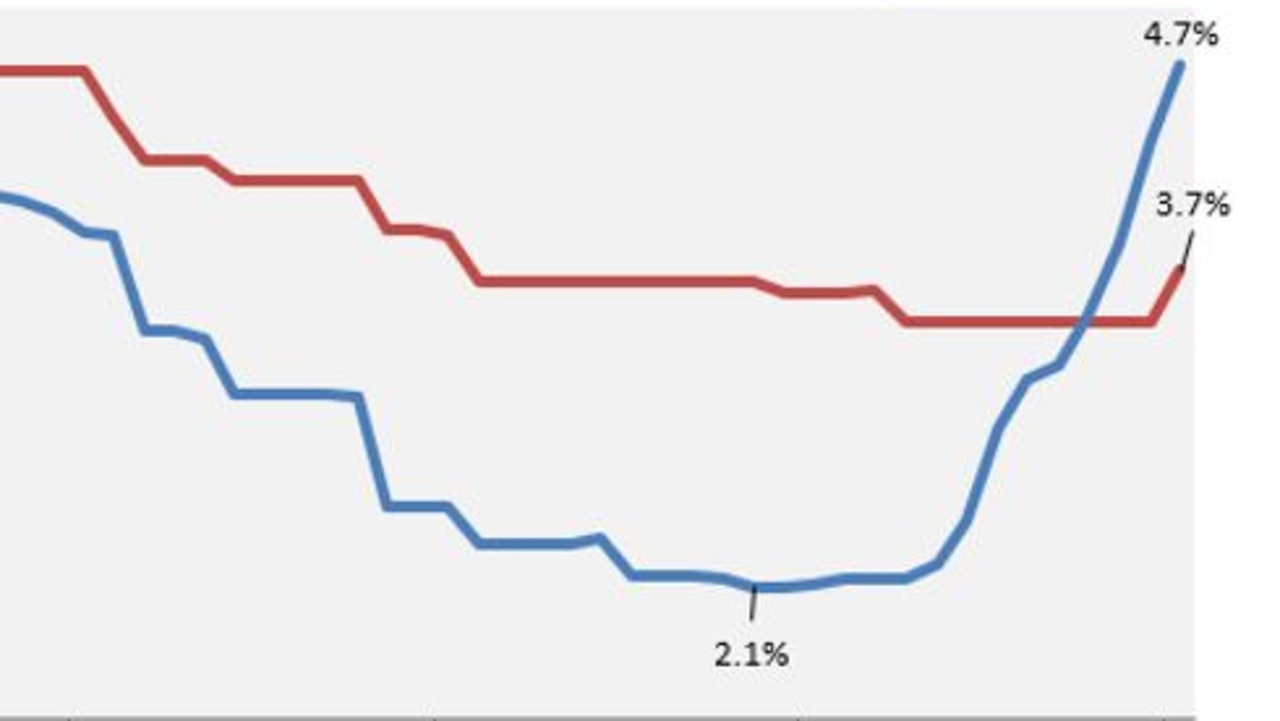

Your bridge financing costs rely on your credit rating. The top rates kepted of these to the high incomes and better borrowing from the bank histories happens to be step three.25%. Those with down credit ratings pays ranging from 8.5% and 10.5%.

Like with home financing, you need to together with shell out various closing costs when you take away bridging money. They might be brand new assessment percentage (and that identifies how much cash your property is worth), an administration commission (to cover the newest work doing work in operating the mortgage), escrow percentage, notary percentage, and you will name plan will cost you.

Really property owners taking out connecting home funds need to pay ranging from 1.5% and you will step three% of the mortgage worthy of in different charges.

The great benefits of Link Funds

- The capacity to buy a new home in the place of very first promoting your own most recent one

- The option while making desire-only repayments during the course of the borrowed funds

- The capacity to end monthly obligations entirely with the first few days of your loan (readily available using specific lenders)

- The capability to make an offer with the property

- Access to instantaneous investment to own short transactions and you will go out-painful and sensitive sales

New Cons off Link Loans

- The constant maintenance costs associated with buying a couple of house in one big date

- High-rates of interest

- The price of individuals charges in the taking right out the mortgage

- The possibility of foreclosures from the financial if you’re unable to promote the brand new house in this a designated period

- The necessity to get a mortgage very first before you can safe a link loan

If you find yourself looking for a link mortgage, always see an established bank. Many providers vow short funds, but there is however always a payment, such high charges, rates of interest, and you will worst customer care. Usually consider these products whenever consider upwards bridge funds compared to. old-fashioned fund.