step 1. Virtual assistant Loan Degree

Jimmy, being an experienced himself, knows first hand the significance of comprehensive education into the Va financing. The guy even offers a personalized method to explain the processes, ensuring their other veterans and you can productive-responsibility professionals have the training they should make told conclusion.

2. Pre-qualification Suggestions

Which have several years of experience, Jimmy is able to examine an effective borrower’s monetary stance accurately. He brings invaluable advice on how experts can also be updates by themselves greatest before the software to maximise the financing possible.

step 3. File Preparing and you can Range

Jimmy’s comprehension of brand new armed forces documentation, with his deep knowledge of Virtual assistant loan criteria, means that all of the documentation was careful. His team’s accuracy speeds up the approval process.

4. Mortgage Alteration

Jimmy’s personal experience once the a seasoned lets your in order to resonate which have exclusive demands away from armed forces family members. From the experiencing it, he can customize mortgage choices one to undoubtedly match private circumstances.

5. Application Distribution

Having canned lots of Virtual assistant applications, Jimmy have a proficient knowledge of possible pitfalls. The guy cautiously ratings the software to stop people missteps, making certain hanging around through the underwriting stage.

6. Liaising having Underwriters

Their longstanding relationships which have underwriters permit effective communication. If any inquiries occur, Jimmy’s relationship assurances they are managed swiftly, to avoid too many waits.

seven. Addressing Borrowing Issues

Understanding the pressures some experts deal with post-services, Jimmy will bring caring and you will standard advice on dealing with borrowing items, leveraging his extensive experience to provide options that other agents might neglect..

8. Va Appraisal Techniques

Jimmy means that experts are not blindsided by possessions affairs. From the coordinating the latest Va assessment techniques, he verifies the assets not simply suits Virtual assistant requirements but along with suits an educated appeal of experienced.

nine. Clarifying Financing Requirements

With a connection in order to clarity, Jimmy deciphers cutting-edge loan standards to own borrowers, guaranteeing they’ve been satisfied timely. Their proactive approach minimizes the opportunity of past-minute surprises.

10. Settling Rates and you may Terminology

Jimmy’s reputation and you may assistance standing him just like the an overwhelming negotiator. The guy ardently advocates for his clients, making sure it get the maximum benefit good rates and conditions.

11. Streamlining new Closure Process

Which have went lots of veterans to their homeownership goals, Jimmy knows the importance of a flaccid closure. He orchestrates the very last methods meticulously, making certain that every detail is actually location for a successful conclusion.

With an excellent Virtual assistant loan large financial company like Jimmy Vercellino, whom specializes in Va finance, means individuals take advantage of the book advantages of the applying whenever you are navigating the reasons off underwriting. Its solutions will bring a boundary facing prospective hiccups, making certain the path so you can homeownership can be smooth as you are able to to own veterans and you can productive-responsibility military users.

The fresh new underwriting procedure to have Virtual assistant fund are a significant phase you to establishes whether a software was recognized, at exactly what words. It involves numerous secret strategies:

- Pre-qualification: Before dive deep to your underwriting process, lenders usually glance at a possible borrower’s budget to incorporate a good harsh guess of one’s loan amount one might be eligible for.

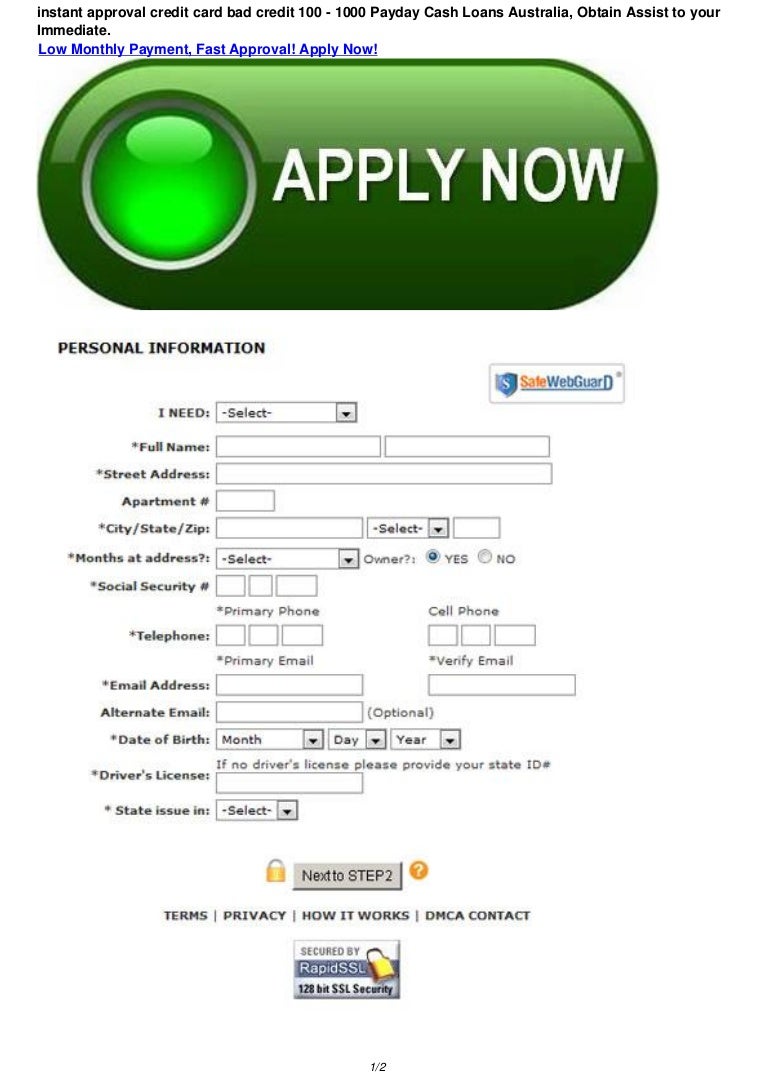

- Loan application: The newest debtor submits reveal software getting all of the expected financial information, including income, bills, https://paydayloanalabama.com/carbon-hill/ and you may property.

- File Collection: The financial institution collects crucial files eg spend stubs, taxation statements, lender comments, or any other associated documents to ensure the fresh borrower’s financial predicament.

- Va Assessment: Book to Va money, an appraisal is bought to evaluate the new property’s value and make certain they match Virtual assistant minimal assets requirements. That it handles this new experienced customer off to buy a sandwich-basic possessions.

- Borrowing from the bank Evaluation: Lenders comment brand new borrower’s credit history to assess creditworthiness, commission records, and you may overall economic behavior. Virtual assistant fund are apt to have more lenient borrowing from the bank requirements as compared to almost every other loan designs.