People up against tough economic minutes have a tendency to use fund offered by the brand new FHA or Government Houses Management. Such finance are still the gold lining for people experiencing bitter financial adversity. Such fund are offered with quite a few positives, especially the low down money (reduced than just step three.5%). Such flexible standards are provided to individuals which includes borrowing challenges and lower profits. Except that pursuing the simple assistance required of the FHA, the new home is to serve particular standards to own brief acceptance. On this page, we’ll attract more about our house and that fails to see the new criteria from a keen FHA mortgage, examine not as much as:

Knowing the Concepts

Very first anything very first, we want to see the rules of your loan provided by the brand new FHA. The brand new Government Houses Administration is influenced by the Company of Houses and you may Metropolitan Invention (HUD). For this reason, it is unavoidable this ruling muscles creates the principles to possess a property for the rejection otherwise acceptance. You FHA is responsible for guaranteeing lenders but is not directly in financing them. Here, lenders (banks) play a crucial role in getting the home denied otherwise acknowledged.

The fresh new FHA demands their acting lenders to take on the new appraisal inspection reports, which have are done by an enthusiastic FHA-recognised appraiser. The lenders, due to their underwriting acceptance, work on account of FHA, and this property suffices their put standards getting insurance policies. That it protection plans obtains the lending company when that loan borrower non-payments from the a later on stage.

Loan Restrictions

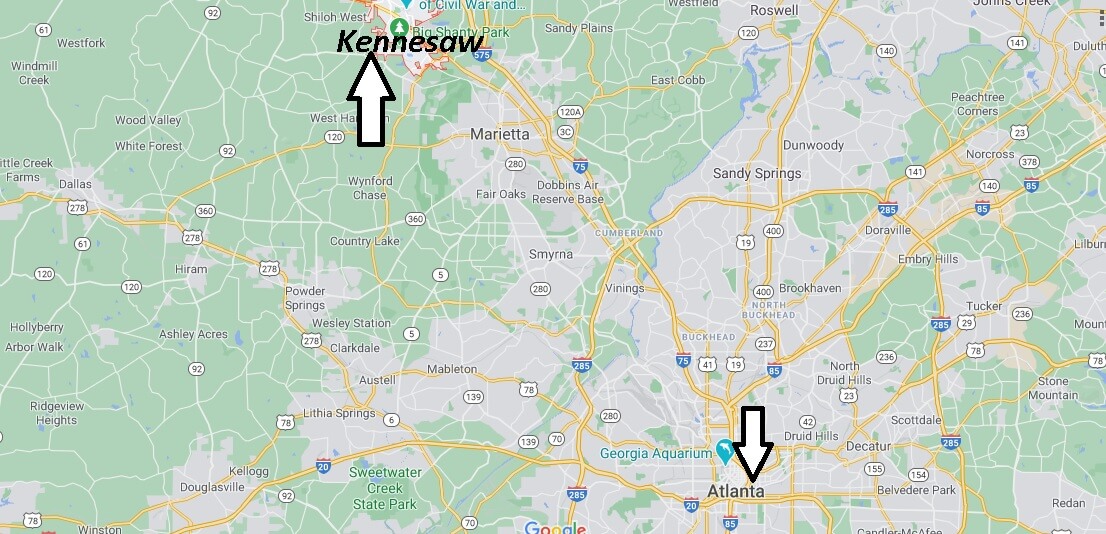

Any pricey home does not qualify for a keen FHA financing having noticeable explanations. Brand new ruling human body (DHU) kits mortgage constraints a year, which differ by the level of devices and you can location. The new FHA has its restrictions so far as the loan amount is concerned. Any high priced house with common FHA downpayment of 3.5% gives you a loan amount exceeding the put restrict. By way of example, San francisco Updates gets the maximum loan limitations because it is regarded as a pricey cost town. This has a threshold around $729,750 for one family home.

Here, a property costs to $800,000 which can be added to at least down payment number of $twenty eight,000 for borrowers whom fail to be eligible for FHA. The mortgage matter remains highest from the an impressive price of $772,000. The debtor will need to $43,000 so you’re able to qualify for a home to the loan.

Condition

For FHA foreclosed residential property, the fresh new FHA can be again generate this type of property qualified to receive the loan. The newest FHA-insured belongings is the properties with fixes only $5000. However, one low-covered land from FHA keeps resolve expenditures of greater than $5000. You could potentially sell courtesy HUD given these types of do not getting entitled to people the fresh FHA fund.

The lenders need their last phone call regarding the rejecting otherwise giving the latest loans Lazear loans the candidate. But not, the fresh comparison away from an effective home’s status of the an enthusiastic appraiser stays an extremely important hobby you to definitely affects the decision away from granting otherwise rejecting any financing. Lenders demand any particular one deficiencies end up being repaired in advance of granting or rejecting the fresh new funds.

As an example, the financial institution might require a property that’s needed is become managed on the exposure of termites and other wood-damaging bugs, mainly if the appraiser denotes termite destroy, which hampers this new structural stability of the property.

The kinds of Functions

Your property financing might possibly be declined if this fails to meet the particular direction towards property particular. For-instance, FHA financing to possess apartments can be regarded as significantly less than apartments developed inside the HUD-accepted metropolitan areas otherwise complexes. Possible discover like FHA-qualified buildings across the HUD’s webpage.

Many of these complexes can easily adhere to the fresh new HUD standards for situations particularly monetary balances, responsibility insurance policies and you can hazards. The constructed land adhere to particular specific norms. Such as for instance, discover a lot of forever fixed house more than the base and you can belong to the true house taxation components. A few of these properties belong to so it standards if the its construction go out falls towards the otherwise ahead of 15th Summer 1976.

Completion

FHA finance are reasonable alternatives for selecting a thorough array of qualities. It has been a systematic selection for people who have reduced borrowing score (below 680 roughly). With has actually such lower interest rates and down payment standards, FHA funds make home-to invest in a practical solution. Yet, it’s got specific requirements to meet up with. These are several issues that reject new FHA mortgage; for those who still have any questions, go ahead and contact us.