However, numerous economists let us know lease manage is a bad idea. Capping the price of things may lead to shortages as manufacturers clean out motivation which will make that particular products.

Remember monetary theory’s prominent lose: Strengthening enough property while drastically lower rents. Regrettably, one level of property production has become a wish to-checklist goods within the California.

- 38 Questions : Exactly what do fix California’s homes clutter? Follow this link!

It is element of Econ 101’s substitution thesis, which defines how customers go shopping for basics including dining, clothes, transportation, properties and homes. It’s why we love a bargain.

We will change chicken to own chicken, or a good car or truck having a special you to definitely. Maybe we perform a property-improvement investment of the ourselves as opposed to choosing a specialist. Whenever airfares are too high, we imagine operating. Or perhaps we’re going to avoid the shop, slowing down orders from, state, the brand new clothing or furniture.

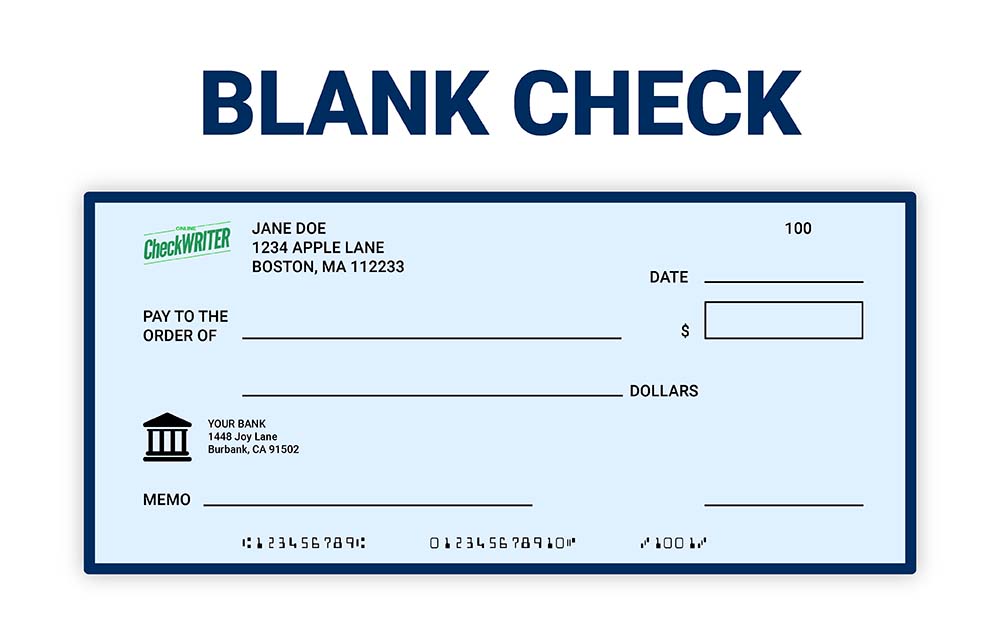

Finding an appropriate flat takes some time and you can research during the a venture that may not free. Many landlords fees software costs to check on in the event the a potential renter fits the qualifications.

Almost as the dispiriting is that people lease coupons in the a moving are probably trimmed from the high will set you back away from physically moving.

Staying in another people setting seeking brand new friends, the brand new schools, this new doctors, brand new churches, an such like. Alter, as well as the cost of that transform, was barely brief or simple.

As to the reasons? Those individuals costs defenses support the book out of much time-label clients well less than just what they’d feel charged once they went in other places.

Monetary split

There are almost 6 mil California leasing domiciles the quintessential of every state, Census Agency data reveal. That is group equals forty-two% of all homes preparations statewide, weighed against renters’ 35% slice all over the country.

- A property Newsletter: Get our totally free Home Stretch’ by the email address. Register Here!

It’s difficult to disregard housing’s monetary separate possibly, once the 56% out of California clients a year ago invested 29% or more of the revenue to your houses, census analysis claims. Meanwhile, simply thirty-five% out of people has actually equivalent financial burdens.

Others lease control

Let’s think of that has trailing new wonder on the financial technology. Fixed-rates mortgages is actually commonly and you can constantly offered, many thanks in many ways to authorities input.

These businesses purchase mortgage loans out of loan providers, repackage the fresh funds with the huge pools getting resale to help you investors. Government entities also promises new disperse away from family money to make certain that those dealers will not be damage from the defaults or foreclosures.

And you can renters, please be aware loans Brookside CO that should you pick a property with one family mortgage, there can be a bonus: the government you are going to processor set for financial expenditures through income tax getaways. Property fees will likely be an effective deduction, also.

Yet not, same as book handle can also be inflate overall rents, it could be contended that financial subsidies unnaturally improve housing costs.

The fresh new rub

![]()

I’m good kid just who grew up in one to area, through New york book control. You will find plus benefitted as the a grownup off government generosity home based-mortgage money.

It’s puzzling if you ask me when men and women claim lease handle incentivizes tenants to remain long, while homeownership is said to produce stability. Long-label residents of the many streak generate area.

- How NIMBY Could you be? Question preferred arguments so you can the homes. Take The Test!

The audience is as well as advised rent manage tends to help wealthier tenants. Really, what’s the financial reputation out of that getting a fixed-speed home loan nowadays?

Now, a collection of really-meaning however, mainly specialist-possession procedures improperly distort the newest housing market. Rent handle is not any magic way to California’s cost demands. But simply evaluate how typically cheaper fixed-speed mortgages essentially froze brand new homebuying sector.

That is a multifaceted mess that’s amplified of the too many roadblocks the official and its particular metropolitan areas toss yourself construction, like leasing tactics.