You choose to own home financing transfer from a single financial so you can a special to take advantage of the benefits of financial transfer mainly a reduced interest levels to own construction financing & improvement in the casing mortgage tenure (susceptible to restrict period to your financial which is 30years).

So you’re able to select the mortgage move into almost every other bank, it is vital that your meet every mortgage import conditions and terms of financial institutions. The newest transfer terms and conditions ong the lenders i.elizabeth. Finance companies & NBFCS, state for example Pvt. Banking companies particularly ICICI & NBFCs such as HDFC Ltd. can also be import your home loan which is 6 months old, just like the nationalized Financial institutions instance Canara you need an one year repayment history in order to techniques our home loan import consult.

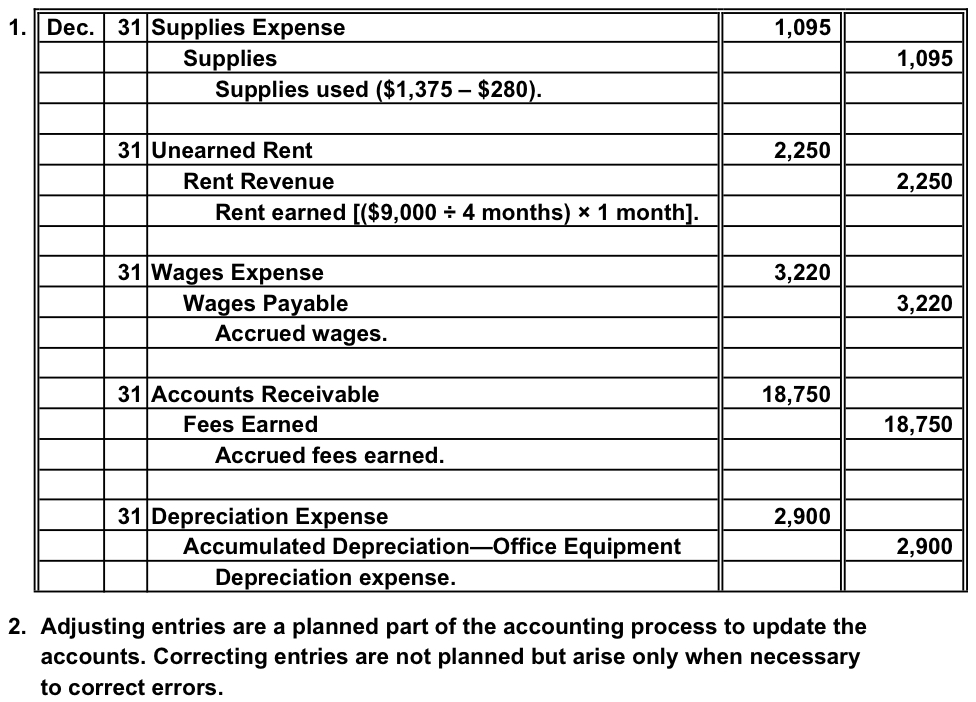

Home loan Transfer Criteria

Home based loan harmony transfer requests banking institutions essentially and you can mostly actively seeks a clear tune record getting houses loan cost by the the brand new borrowers. This new property mortgage payment schedule / history need to be without one EMI bounces, EMI late repayments & excessive EMIs. Punctual repayment away from mortgage EMIs may also earn a lowest notice for the home loan. A beneficial fees history to possess a dozen-1 . 5 years is necessary so you’re able to transfer their higher appeal rates home loan to a new bank which have low interest rate financial. A half a year dated mortgage normally transmitted with chosen banking companies, specifically ICICI & HDFC.

You need to have a regular disperse of money four weeks if you want to switch financial to a different financial. Lender ascertains the fees capability on such basis as your revenue qualifications. A borrower which have disturbed disperse of cash cannot benefit from the benefits off home loan transfer. Even although you has continuous earnings circulate cash you manage an account harmony into EMIs, home loan harmony transfer is achievable.

A mortgage transfer grampanchayat house is maybe not acknowledged. The home needs to be in approved business limits out-of this new authority and ought to be tested by BMC, TMC, MHADA, CIDCO, KDMC, VVCMC, MMRDA etcetera. towards characteristics about urban city of Mumbai. Grampanchayat functions are often maybe not transferable because of the top home loan Financial institutions and you will NBFCs.

A mortgage taken on around framework property can’t be transferred except if new borrower has had the fresh new fingers of the home. In under-build mortgage brokers you have to pay just the attention add up to the financial or perhaps the mortgage is partly paid, hence, if you do not get the palms of the property and start spending a full EMIs to have atleast six months your house mortgage cannot getting transmitted. (Click to understand In the event that Pre EMI is superior to full EMI). You are required to promote a duplicate of your own fingers page with other mortgage transfer records when opting for new mortgage option.

Ensure that your loan isnt regarding lock-within the months whenever you are changing the bank getting lower financial rate. Particularly ’s the better condition to possess fixed rate of interest home loans. In repaired interest rate mortgage brokers their interest rate stays repaired for a fixed period say having 1year, 3years, 5years, 10years or 15years with respect to the banking contract. Significantly less than fixed rate of interest home loans you are recharged a penalty to possess preclosure of your home loan and this ount dependant on the brand new Bank/NBFC.

All of the co-owners of the home must be co-candidates toward loan. To have mortgage equilibrium transfer all of the co-candidates need to offer their accept transfer the loan. Especially when a home loan try availed about term out-of a couple of siblings. To the price in the event your mortgage is usually to be transported on one term or an applicant when you’re obtaining a harmony transfer, one other co-candidates must throw in the towel their residence ownership liberties by finalizing good discharge deed.

Financial transfer of spouse to help you partner and vice-a-versa, mortgage import regarding moms and dads so you’re able to children (young buck & daughter), financial import regarding sister so you’re able to brother or vice-a-versa, financial import off brother to sis, are among the examples of financial transfer to a unique person.

A good CIBIL rating off 750 significantly more than is an effective CIBIL get for everybody type of mortgage conditions. Finance companies study their payment capability of the pulling-out the CIBIL report. Low/worst CIBIL rating puts matter on cost capability and you will banks prevent investment on the grounds of risky off non-payments. But not a minimal CIBIL score property mortgage can be felt getting balance transfers because of the Finance companies/NBFCs however, particularly transmits fundamentally may not earn you a reasonable interest to own casing loan.

A leading up put on fulfill your own top-notch and personal need are at the mercy of brand new fulfilment of your adopting the standards:-

ii) LTV Norms New cumulative amount borrowed of your own equilibrium transfer and you will best-up matter doesn’t surpass the latest LTV norms of one’s bank which is 80% of your market value of the property.

iv) The big-up financing was billed during the a mortgage rates of interest to own the major-up number exceeding the first home loan number.

Home loan Import Info:

- Home loan Transfer Focus RatesStarts out-of 6.95% p.a beneficial.

- Better Mortgage Period:Financial Transfer Lowest Period 5 yearsHome Loan import Restrict Period 3 decades

- Control Fees Upto 0.30% for the amount borrowed + relevant GST.Knowing done a number of costs Click

- Home loan Balance Transfer Charges Rbi GuidelinesAs each the brand new RBI recommendations NIL Pre-closure/Foreclosure Charge are applicable toward a drifting rate of interest mortgage.

- Mortgage With Low Rates Inside IndiaMinimum mortgage appeal rates readily available try 6.95% having Canara Financial (Your loan amount), ICICI Lender (Your loan amount-creator possessions pick) and HDFC Financial (Getting loan amount below 30lacs for ladies borrowers).

no credit check loans Oxoboxo River, Connecticut

Having ICICI lender mortgage transfer, ICICI financial financial equilibrium transfer having finest upwards, mortgage transfer from ICICI Financial to HDFC, home loan transfer away from HDFC so you’re able to ICICI Financial, mortgage move into HDFC Lender,home loan move into ICICI Lender, mortgage transfer to Canara Bank check out You can email all of us towards or actually speak to our masters on the 9321020476.

On the web Processes For Home loan Transfer

Home loan transfer has become smoother for the on the web control of one’s mortgage. Picked banking institutions such ICICI & HDFC have started home loan import on line. What you need to carry out was put your ask for this new import, discover product, publish your posts alongwith new properly closed loan application mode and submit towards the on the web control off home loan harmony import.