- Include you to ultimately the newest electoral move

- Open good British savings account without having that already

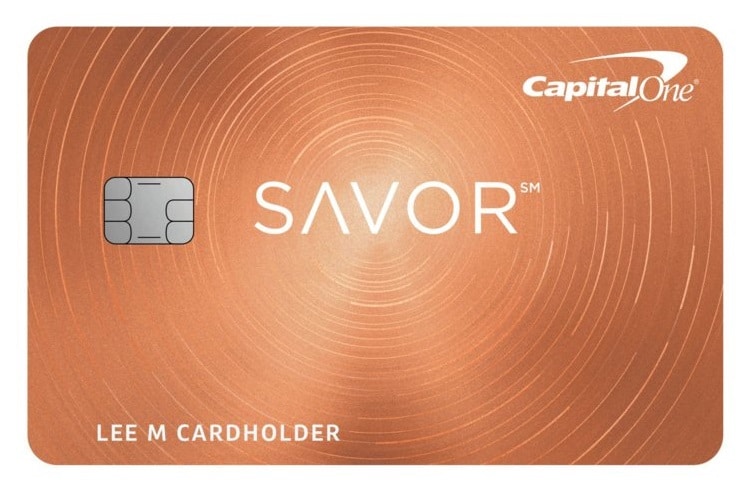

- Think a charge card – borrowing from the bank builder notes are specially built to direct you towards it area. You really need to make certain you’ll be able to pay off people paying with this card regarding the right styles, and you can preferably in the same day to get rid of one notice fees

- Lay a software application bill on loans in Dotsero your identity

- Thought a cellular phone price – if the contract is actually affordable and you will right for your needs

Getting some of these tips could help to get a great start on strengthening your credit report on ground upwards, and it also may not be long before you’re in a far greater status to apply for a home loan.

If you’ve felt like that you would alternatively devote some time so you’re able to establish their credit provide your self the means to access a wider variety of mortgage affairs, you might be wanting to know how much time you are going to need to wait so you’re able to purchase.

Typically, any open and effective membership usually takes to 6 months so you can begin improving your credit score, however you will also want to help keep your lines of credit energetic on the mortgage software way to ensure that your score stays match.

Will i you need a much bigger mortgage deposit if i do not have credit history?

If you find yourself getting off more substantial mortgage put have a tendency to generally make you entry to finest and much more reasonable sales, which have zero credit rating doesn’t necessarily make this a necessity.

In order to safer a residential mortgage, you can easily generally need a deposit which is 1020% of worth of our home you are searching to purchase. And you will, even without any credit, while you are in a position to spend that it initial, there are financial facts available that you are capable secure. Regardless of if all of the situation is exclusive, making it smart to consult with a professional financial broker in advance to get a concept of exactly how much you really need to save yourself before you apply.

How to get a mortgage no credit

If you have zero credit however, need certainly to secure the very favourable home loan speed you’ll be able to, it’s vital which you work on a professional mortgage broker just who can familiarizes you with loan providers that offer factors designed especially for members of your position. While most standard banks and well-known lenders wouldn’t consider carefully your application anyway, there are enterprises online that may.

Going to the incorrect financial once you don’t have a credit rating can cause you spending too far for the mortgage, while having apps turned down have a detrimental influence on your rating, so it is actually more complicated to getting the mortgage your you would like. Very, it is very important work at someone who understands this new landscape, has actually good connectivity that have a great system from financial providers, and can support you at every action of one’s procedure.

Extract to each other normally evidence that you can that presents you may be financially responsible and you will saving a wholesome put could also be helpful to get you within the a robust position and reduce the possibility of the software getting denied.

In advance of one improvements on the mortgage front side, i highly recommend examining the Credit reports. The ultimate way to accomplish that has been our free equipment – Evaluate My personal File. Its free toward first 1 month, you could terminate at any time once you’ve installed your statement.

We hope you now have a much better comprehension of what the process is particularly if you are planning to get a home loan however, actually have no credit rating. Here at The loan Genie, we’ve helped most somebody as you buying this new house they usually have constantly dreamed of, and now we would love to help you with the home loan software, also!