A consumer loan is a financing product which allows a debtor in order to rapidly score money which can be used for pretty much one purpose, together with scientific costs, debt consolidation reduction, or automobile repairs.

A mortgage is actually home financing accustomed money the acquisition away from a property, that’s paid more than 20 or three decades. When you are an unsecured loan was a general-purpose financing, a home loan is utilized for real property instructions.

Secret Takeaways

- A consumer loan lets a debtor to quickly score finance one to can be used for nearly people goal, together with medical expense, debt consolidation, otherwise vehicles fixes.

- A consumer loan can be unsecured, definition there’s absolutely no guarantee backing the borrowed funds.

- Mortgage loans are usually accustomed pick a residential property and generally are covered by assets bought with the mortgage.

- Personal loans can usually end up being funded quicker than mortgage loans, however they have high interest rates.

- A mortgage usually means a lot more rigorous prerequisites, together with an appraisal of the home.

Personal loan against. Mortgage: An overview

Both personal loans and mortgages is sorts of obligations. A loan provider will give you capital initial, while repay the lender through the years. Along with paying the money you owe (known as prominent), you pay notice, which is the commission you have to pay for making use of the fresh new lender’s money and work out your purchase.

Unsecured loans and you can mortgage loans is actually both fees funds, thus you will be aware whenever you’ll be done repaying your debt. This type of percentage dates have repaired or varying rates. That have a predetermined speed, you have to pay an identical amount monthly, while the desire payment doesn’t change. A variable price, in the event, changes. Because of this if interest rates rise, the lowest monthly payment will also increase to keep you towards the tune to repay the borrowed funds inside conformed-on time frame.

Every type of mortgage might also feature certain fees, like the odds of an enthusiastic origination fee in order to process that loan app. When evaluating the loan terms and conditions, be sure to know what using up loans could cost your, regardless of whether you earn an unsecured loan otherwise a home loan.

It is important to notice, however, one signature loans are often (although not usually) unsecured, so if you fail to generate money, this new lender’s main recourse will be to sue your or post your membership his comment is here so you’re able to collections. Likewise, a mortgage can be used purchasing real estate, so if you cannot make payments, the lending company can repossess the property and then try to sell it to recover some of the money that they laid out.

Personal loans

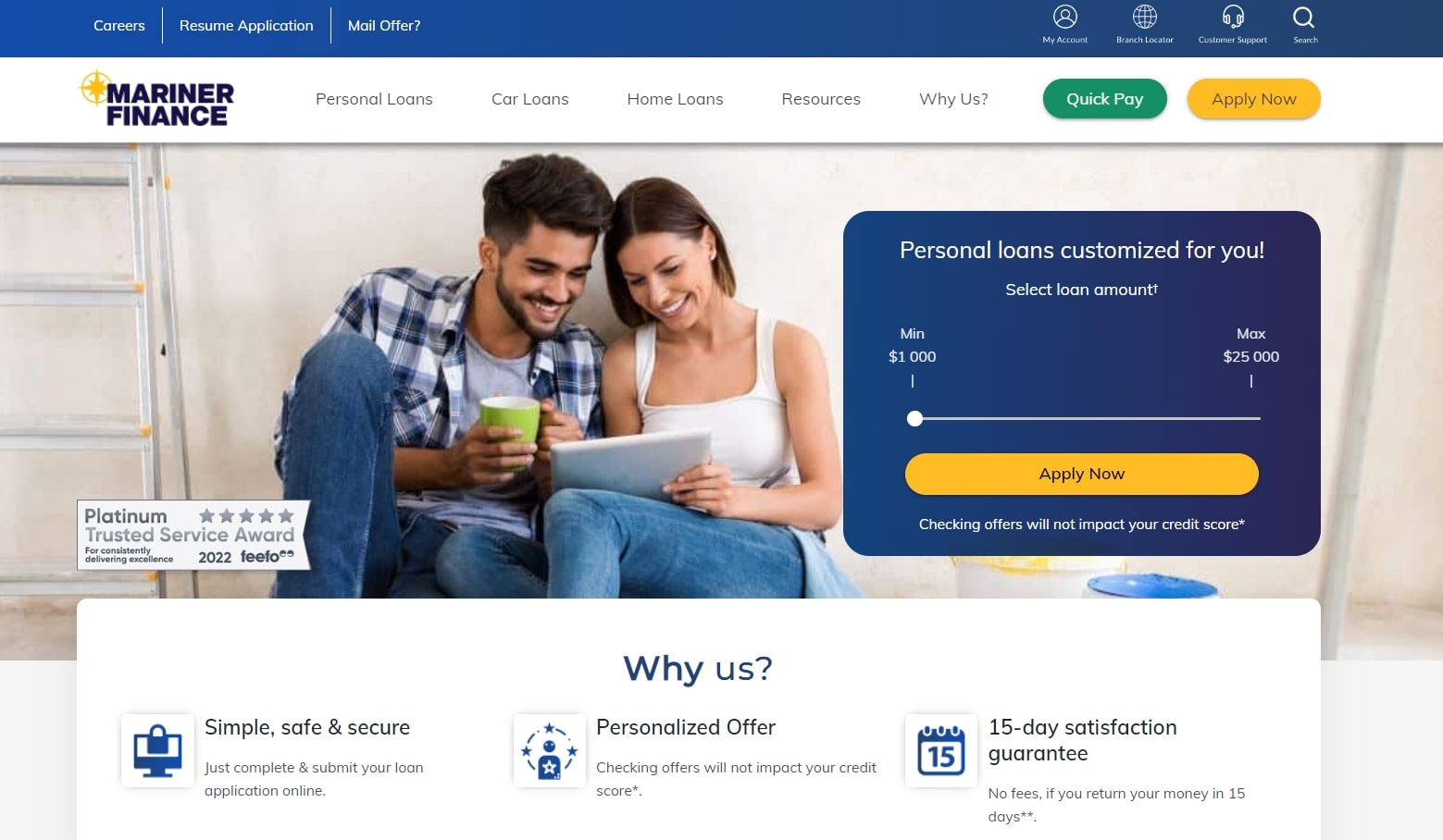

Personal loans usually are unsecured, definition they don’t require you to render security as the security during the case away from nonpayment. With regards to the bank, you can use only $step 1,000 otherwise up to $fifty,000 or higher. Repayment terms normally last several in order to 5 years, no matter if that can and are very different by financial.

Some loan providers promote secured personal loans. If that’s the case, you might have to put down something beneficial given that security, particularly a motor vehicle identity otherwise a bank account. According to lender, it could be you can to find a lower interest rate in the event the you will be ready to provide security.

Interest rates to your unsecured loans may have huge variations, depending on the lender plus credit history. For those who have a high credit history, you will be qualified to receive a high loan amount and you can a good lower rate of interest. As well, a reduced credit history might result in a top interest and restrictions on how much you could use.