Are you searching for regulators programs to help you buy a home? If so, you’re in chance! There are various out of regulators programs that are designed to assist people into a disability buy property. These types of software are the Handicap and you may Earliest Home buyers Tax Borrowing from the bank, the new Housing Program to have Impairment Earnings, and the Property owners Grant. Continue reading to determine how these software helps you buy a property.

Brand new Handicap and Earliest Homebuyers Taxation Borrowing from the bank in the country are an economic extra to invest in a property, and is accessible to Canadians that have handicaps. These folks can allege a $5,one hundred thousand taxation borrowing when they get a qualifying household. not, there are a few issues that must be found so you’re able to be eligible for the credit. The newest disability must be off a qualifying nature and must be documented. Brand new handicapped personal need a handicap one to restrictions their otherwise their capacity to perform specific factors, in which he or she need certainly to get a home which have usage of during the attention.

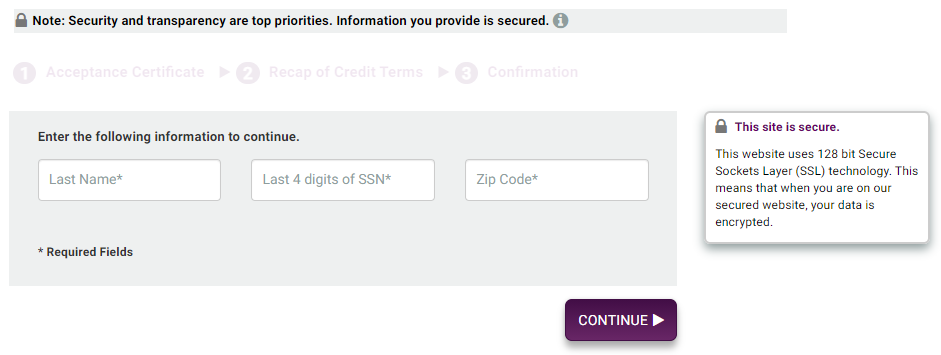

The Impairment Taxation Borrowing from the bank is not refundable, and you need to be approved by the CRA before you apply for the financing. But not, it can will let you backdate your handicap tax borrowing from the bank. Needed a physician so you’re able to fill in the T2201 function, claiming the severity of your problem as well as how it influences your own power to individual a home. When you find yourself qualified, you might submit the design along with your application and you may discovered an effective income tax credit contained in this 6 months.

Resident offer for people with handicaps

Government entities even offers grants for disabled homebuyers from the Property Choice Voucher Homeownership Program. The federal government even offers loans or any other prominent home loan applications so you can handicapped someone. Handicaps are very prone to dangers at home and often face a steep discovering contour for the obtaining requisite experience and feel to be a resident. To simply help disabled anybody end up being home owners, many authorities companies and nonprofit groups give has and you may home loans for these with handicaps.

Your house Holder Grant for those who have Handicaps helps disabled somebody get or tailor the principal residence. Individuals need to be 65 many years or old and you will rely on handicap spend otherwise Supplemental Safeguards Income for their income. They could sign up for to about three provides totaling $17,130. Candidates need to plan to remain in the property for some time time. The new give try awarded for up to three separate projects. You are eligible for several offer depending on the sort of handicap you’ve got.

Houses Program getting Handicap Earnings

The Property Program to have Impairment Income within the Canada was developed so you can let Canadians which have handicaps on cost-of-living. The applying began inside 1986, initially having lowest-to-moderate income residents inside designated people improve components. This program sooner advanced to add funds and you can has to your type away from characteristics. Into the was launched to simply help people who have disabilities to the will cost you from property. Beneath the system, eligible people is https://paydayloansconnecticut.com/ receive gives and you may fund of up to $ten,100, with regards to the number of their earnings. Inside the 2016, over fourteen,700 people with disabilities obtained RRAP-D improvement.

Plenty of analytics show that construction charges for those with handicaps will vary. A number of the signs into the housing cost of individuals that have handicaps is actually separated by disability sorts of. Cognitive disabilities, such, differ from those individuals because of serious pain. It is important to remember that these are different variety of disabilities. Towards purposes of researching housing will cost you certainly one of people who have disabilities, government entities from Canada publishes the new GBA As well as. Such indicators depend on the new CSD throughout the 2016 Census out-of People.