Additionally, benchmarking against industry standards can provide insights into competitive accrual practices. This helps companies remain attractive to potential hires while retaining existing talent. The term “accrual” derives from the fact that expenses are recognized in an accounting period other than when they are paid—when they have accrued. Similarly, if an income is time-related myths about doing your own taxes and that time has passed (e.g., interest on a bank deposit), it should be recorded in the accounts even if it hasn’t been received in the corresponding accounting period. Although the definition might seem a little complicated at first reading, this is essentially a simple idea. Accrual accounting is important for an enterprise in terms of accurately recording sales and purchases.

What Are the 3 Accounting Methods?

- In this post, we’ll go over what you need to know about the accrual method of accounting, including its benefits, how it compares to cash accounting, and if it’s right for your business.

- The specific journal entries will depend on the individual circumstances of each transaction.

- Recording cash transactions based on when you complete services, deliver products, and incur expenses is also beneficial to your business.

- Still, caution should be used, as there is still leeway for number distortion under many sets of accounting principles.

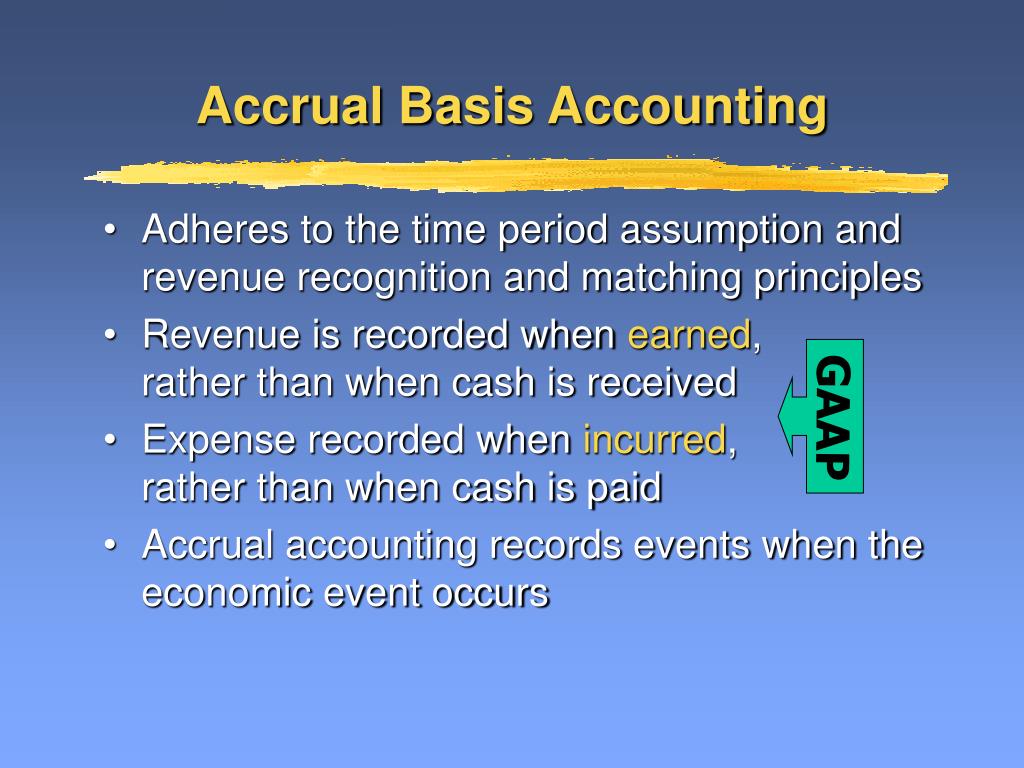

- Accrual accounting is an accounting method that records revenues and expenses before payments are received or issued.

Then, in February, when you receive the payment, you’ll credit accounts receivable, which means receivables go down, and debits cash, which will go up. Though people commonly confuse accrual accounting with cash accounting, there are some stark differences to know before choosing which is right for your business. Whether it’s GAAP in the U.S. or IFRS elsewhere, the overarching goal of these principles is to boost transparency and make it easier for investors to compare the financial statements of different companies. In the case of rules-based methods like GAAP, complex rules can cause unnecessary complications in the preparation of financial statements.

Recording Accruals on the Income Statement and Balance Sheet

The company must make journal entries to record accruals on the balance sheet to reflect the revenues and expenses that have been earned or incurred but not yet recorded. A company would make a journal entry to record the revenue from that service as an accrual if it’s provided a service to a customer but hasn’t yet received payment. This would involve debiting the ”accounts receivable” account and crediting the ”revenue” account on the income statement. The choice between accrual and cash basis accounting can significantly influence how a business’s financial health is perceived. While both methods aim to provide a snapshot of financial performance, they do so in fundamentally different ways.

What Is Accrual Accounting?

Having the proper timeline for such transactions helps financial records to align with business activities and make changes as per business goals. Consider a scenario where an employer pays wages to its employees on the 20th day of the month for the hours they worked. In such a case, employers can accrue any additional wages earned from 21st day to the end of the month, ensuring full amount of expense on wages gets recorded in financial statements. When accrual accounting is implemented in a company, it depicts a more accurate position of business finances.

More Time and Cost

11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Investors can use this information to make more informed decisions about a company’s current and future health. Despite its shortcomings, accruals remain a valuable and essential tool for investors, especially when used alongside other performance metrics. Businesses could also be using “off-balance-sheet financing” techniques which means not including certain operating leases as part of current assets/liabilities. Investors can view these as real assets and liabilities instead of unrealized gains their balance sheet. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism.

The liability account will be decreased through a debit and the cash account will be reduced through a credit when the payment is made in the new year. The accrual method does provide a more accurate picture of the company’s current condition, but its relative complexity makes it more expensive to implement. Conversely, some organizations implement a “use-it-or-lose-it” policy, where unused vacation days are forfeited if not taken by a certain date.

This is because accruals are portrayed in financial statements that indicate the financial health of the company. This happens due to the availability of information on accounts payable and receivable. Instant portrayal of where money is coming from and going out is expected in future reports, making performance assessment easy. Under Accruals basis of accounting, income must be recorded in the accounting period in which it is earned. Therefore, accrued income must be recognized in the accounting period in which it arises rather than in the subsequent period in which it will be received. The journal entry would involve a credit to the revenue account and a debit to the accounts receivable account for accrued revenues.

Imagine your small furniture company delivers a full bedroom set worth $6,000 to a client on March 1st, but you set the invoice due date as April 15th. Using the accrual method, you would record the $6,000 for services rendered as revenue right away, regardless of when the client pays the bill. It occurs when you’ve received a good or service, and the vendor expects you to pay at a later date. For example, if you’re a caterer, and your food supplier provides you with $300 of lamb chops on March 15th, with an invoice due on April 15th, you would call that $300 an accrued expense. Accrual accounting remains an integral part of financial accounting today because it allows businesses to account for all transactions that have yet to take place concerning revenues and expenses alike.

This happens when you receive a good or service, but the provider expects you to pay at a later date. For example, let’s say you received merchandise for your business in March and received an invoice of $500 with payment due in April. This is common when customers pay for a subscription or have recurring payments, like a phone bill. For example, let’s say a customer paid $100 for your consulting services in January, but you’ll only be providing the service in February.

Part-time employees present unique challenges in vacation accrual management, as they often work variable hours and schedules. Organizations need to establish accrual systems that reflect the proportional nature of part-time work while maintaining fairness and consistency across the workforce. This often involves calculating vacation accrual on a pro-rata basis, where part-time employees earn vacation time in proportion to their hours worked compared to full-time staff. This method ensures that part-time workers receive benefits commensurate with their contributions, fostering a sense of equity and inclusion. A foundational step in calculating vacation accrual rates is to analyze the organization’s historical data on employee usage and turnover. By understanding patterns in how employees utilize their vacation days, businesses can tailor accrual rates to meet actual employee needs while maintaining productivity.

It can simultaneously record revenue of $100 each month to show that the revenue has officially been earned through providing the service. Kristen Slavin is a CPA with 16 years of experience, specializing in accounting, bookkeeping, and tax services for small businesses. A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance.